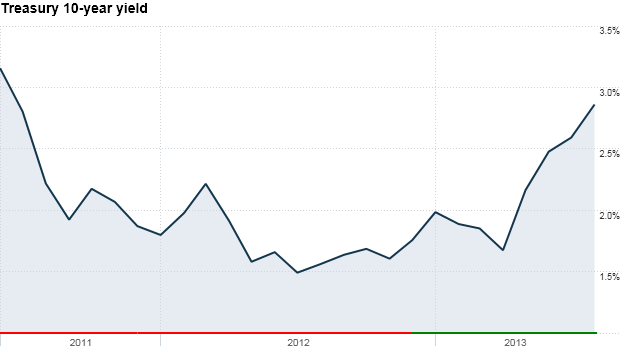

Click chart for more market data.

NEW YORK (CNNMoney)

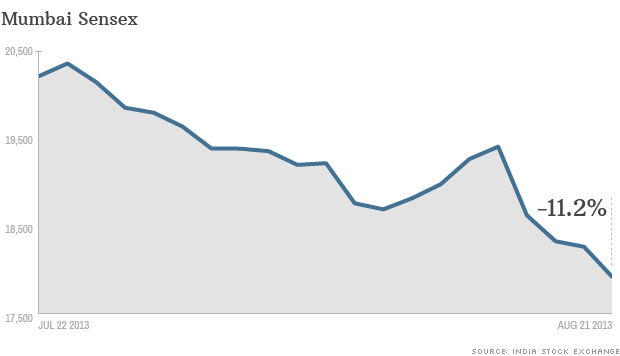

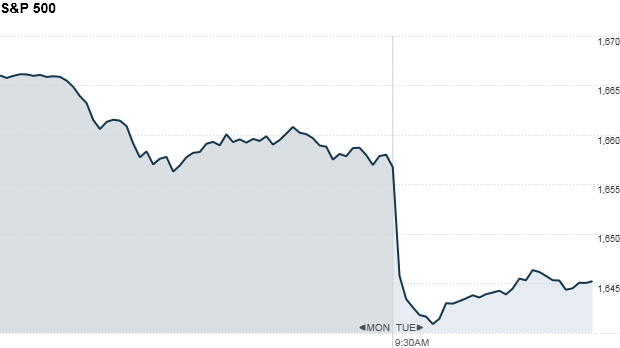

The Dow Jones Industrial Average, the S&P 500, and the Nasdaq all fell in morning trading, following global markets lower.

Investors moved into assets deemed "safe," pushing up the prices of gold and U.S. and German government bonds. Oil prices also surged on fears in the Middle East.

Click here for more on stocks, bonds, currencies and commodities

Investors have grown increasingly concerned that the U.S. and its allies are preparing for military action against Syria. Secretary of State John Kerry said Monday that evidence "strongly indicates" chemical weapons were used in Syria.

Related: Military strikes likely response?

Kerry's comments were interpreted as a war speech, sparking a downward move in the Dow Jones industrial average and S&P 500 during the final hour of trading on Monday. It also erased modest gains in the Nasdaq.

Still, Tuesday's sell-off was relatively mild. It is expected to be another light day of trading in the late August doldrums. What's more, major U.S. indexes are still up between 14% and 20% in 2013.

Home prices keep rising: U.S. investors got more good news about the housing market. Prices for homes in the nation's 20 largest cities in June rose 12.1% over the last year. That was down slightly from the previous month, but still shows that housing continues to rebound.

Related: Fear & Greed Index shows Extreme Fear

Luxury retail rises, while lower priced retail falls: Shares of jewelry retailer Tiffany & Co (TIF) rose after the company reported better-than-expected quarterly results.

Shares in struggling department store operator J.C. Penney (JCP, Fortune 500) fell on news that activist shareholder Bill Ackman is selling his entire stake of more than 39 million shares.

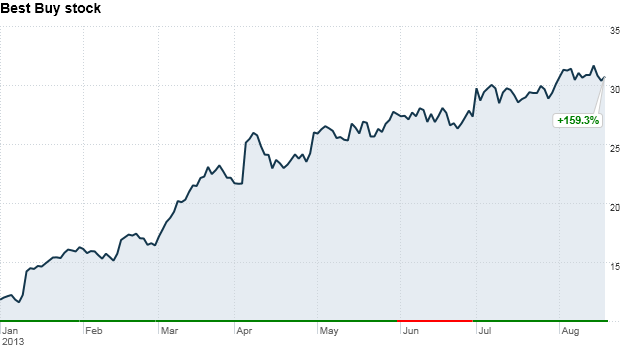

Shares of electronics retailer Best Buy (BBY, Fortune 500) fell after its founder Richard Schulze announced that he would begin selling his stake in the retailer in October. Last year Schulze attempted to take Best Buy private but was rebuffed by the board.

In Australia, shares in surfwear maker Billabong plunged after it posted a huge loss and wrote off the entire value of its brand. ![]()

First Published: August 27, 2013: 9:46 AM ET