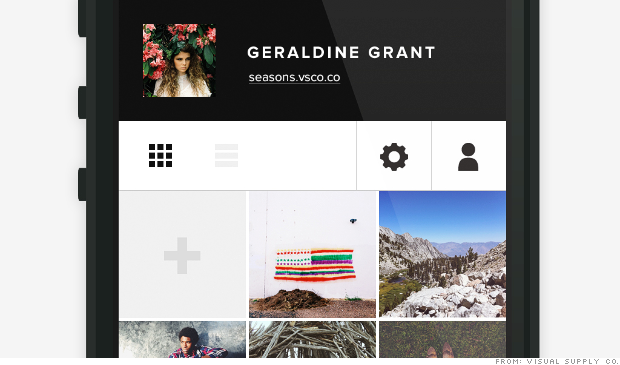

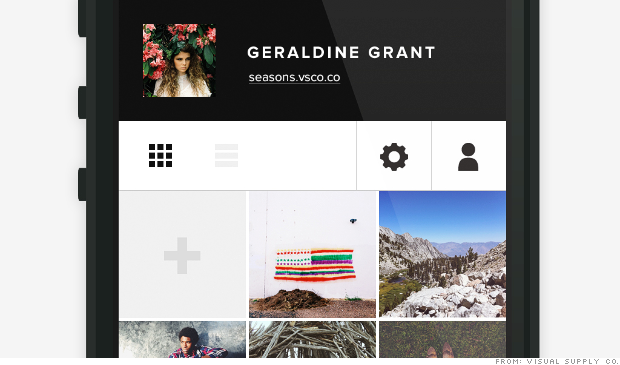

VSCO cam is the best one-stop shop for photo taking, photo editing, photo organizing and photo sharing

NEW YORK (CNNMoney)

Sure, you know about Facebook (FB, Fortune 500), Twitter (TWTR), Instagram, Pandora (P), Yelp (YELP), Google (GOOG, Fortune 500) Maps and Netflix (NFLX). But what about the rest?

Lucky for you, we have some recommendations.

Whether you want new apps, essential apps, or apps specific to your new iPhone, iPad or Android device, we got you covered.

5 new apps

Ridiculous Fishing - There are very few games that are truly and uniquely suited for smartphones. Ridiculous Fishing is one of them. [iOS, Android, $3]

Dots - It's like Candy Crush, but better. [iOS, Android, Free]

Vine - Twitter's (TWTR) strange little video-sharing app is still figuring out exactly what it is, but it's growing legion of experimenters are beginning to answer that question. [iPhone, Android, Free]

Hangouts - After years of amassing Gmail chatters, Google FINALLY created a truly unified, cross-platform messaging solution for all its products. It also means iPhone users' days of using horrible third-party apps are over. [iOS, Android, Free]

VSCO cam - VSCO cam technically debuted in 2012, but the second generation of the app has been so thoroughly overhauled that it's essentially a whole new app. It's the best one-stop shop for photo taking, photo editing, photo organizing and photo sharing. [iPhone, Android, Free]

Related: Tips for getting started with your new mobile gadget

5 cross-platform apps

Snapchat - The self-destructing photo and video sharing app first appeared last year, but it wasn't until the second half of this year that the service really hit its stride. The fun is undeniable. [iPhone, Android, Free]

WhatsApp - This may not be the BEST chatting or texting app, but you won't find a service on more devices, used in more countries, with more active users. [iPhone, Android, Free]

SoundCloud - If you mixed the old MySpace Music with Twitter, you'd end up with SoundCloud. And it's so much better than it sounds. Follow your favorite artists, labels, publications or users, and every time they upload new music to their profile, it ends up in your music stream. This is radio for a new era. [iOS, Android, Free]

Dropbox - There's a very good chance that if you're using a cloud service, it's Dropbox. There's also a good chance that's what your friends are using too. Might as well have your account within tapping distance on your phone. [iOS, Android, Free]

Kindle - The Kindle app is not only the best and most flexible way to consume e-books on your phone or tablet, but is also great for reading other documents including PDFs. [iOS, Android, Free]

5 apps for iPhone

Google Search - Once upon a time this was maybe the most worthless app Google offered for an Apple (AAPL, Fortune 500) device. But once Google baked in its voice recognition technology and its Google Now predictive search, it's a must-have. Neither feature is quite as good as you'd find on a device like the Nexus 5 or Moto X, but it's close. [Free]

Fantastical 2 - If you don't like the stock calendar app on iOS 7 (and many don't), Fantastical may be the substitute that meets your needs. [$2 for a limited time]

Level - Level automatically sets up a daily, weekly and monthly budget for you, and then quickly and simply keeps you updated on your spending habits. [Free]

Mailbox - If you happen to be a mailbox zero devotee, you won't find a better mail client. [Free]

Figure - There is no easier way to make yourself sound like a musical genius when you have 10 minutes to kill. [$1]

5 apps for Android devices

1Weather - There's not really a great default weather experience baked into Android, so 1weather offers the best combination of usable information and clean design. [Free]

Google Now Widget - Google Now's contextual/predictive search is baked into the default search app that comes preloaded on most Android devices. But sticking the widget on your home screen gives you the info you want before you even know you want it. [via Android home screen]

SwiftKey 4 - Once you get the hang of it, gesture-based keyboards are faster and more accurate than tapping at the screen. And, though Android has its own default solution, Swiftkey is still the best of the bunch. [$2]

Aviate - The stock Android home screen is pretty good, but if you're looking for something different, give Aviate a try. It's certainly cleaner than anything you'd find on phone from Samsung, LG, or Sony. [Free]

Car Widget - If you commute to work every day, you should not be navigating your way through the normal Android UI. Car Widget puts the apps you need front and center. [Free]

5 apps for iPad

Paper - Hands down the best consumer-facing app for drawing, painting and sketching. It doesn't do everything under the sun, but it does what it does extremely well. [Free]

iA Writer - This is a no-nonsense word processor that provides minimal distractions. [$5]

Traktor DJ - If you've ever wanted to try your hand at DJing, but didn't want to drop a small fortune on the gear, just download this app and call it a day. [$10]

How to Cook Everything - Tablets are excellent aids in the kitchen and there are few books on cooking better than Mark Bittman's opus. [$10]

Superbrothers: Sword and Sworcery EP - Infinity Blade III might be the most technically impressive iPad game, but even three years after its release, Sword and Sworcery is the most original and engaging iPad game you'll encounter. [$2]

First Published: December 24, 2013: 2:11 PM ET

![]()