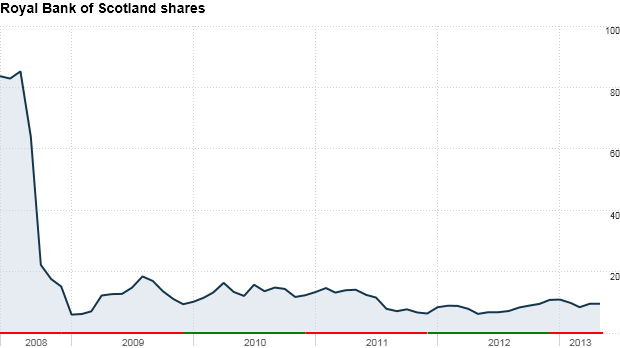

Most high-end smartphones cost just $200 after discounts, but that practice may end soon.

NEW YORK (CNNMoney)

It's no secret that wireless companies are trying to do away with subsidies. Typically, customers pay a discounted price up front for their phones and then work the cost off over the course of a two year contract.

This has helped carriers lure in customers and lock them into long-term deals. But those discounts are also bottom-line killers, particularly when subsidizing super high-end devices like the iPhone from Apple (AAPL, Fortune 500). The iPhone carries by far the largest subsidy on the market.

A 16 gigabyte iPhone 5 without a contract sells for $649 on Apple's website, for example. But you can get the phone from a major carrier for $199 with a contract. In quarters in which a new iPhone launches, profit margins for the wireless businesses of Verizon, AT&T and Sprint often plunge.

Carriers usually knock of $400 from the price of top smartphones running Google's (GOOG, Fortune 500) Android operating system, including the Samsung Galaxy S4, as well. That's why wireless companies are beginning to look at ways to end subsidies.

Related story: The iPhone is a nightmare for carriers

Some international carriers have already gotten rid of the price discounts. Others are offering bring-your-own device deals and creative financing options,

In the United States, the first to do away with the subsidy -- sort of -- is T-Mobile (TMUS).

The No. 4 carrier, which has branded itself "the uncarrier," is offering contract-free service plans for customers who buy full-priced phones or already own one that they want to switch to T-Mobile's service. It also offers financing options for subsidized phones, though those customers still need to sign up for a two-year contract to get those deals.

Even though T-Mobile isn't going as cold turkey on subsidies as it claims, it has caught the attention of rivals. The CEOs of Verizon (VZ, Fortune 500), AT&T (T, Fortune 500) and Sprint (S, Fortune 500) have all said recently that they are looking closely at what T-Mobile is doing.

Sprint CEO Dan Hesse said on a conference call with analysts last month that carriers can't keep discounting phones "because subsidies just keep going up, and ... the industry can't afford to upgrade as often." Verizon recently lengthened its contracts by four months -- from 20 to 24 -- to get more bang for its subsidies.

Related story: T-Mobile blows up cell phone pricing model

Industry experts said there are other factors that could lead to the end of subsidies ... or at the very least, smaller discounts.

"Is the subsidy-model definitely going away?" asked Pierre Alain Sur, leader of PricewaterhouseCoopers' global communications business. "It's hard to say at this point, but the trend is pointing that direction."

Smartphones are becoming more durable, and innovation is slowing. Apple is still selling crazy amounts of the iPhone 4, a device that was launched two years ago.

All that's left is to change customers' mindset. Interestingly, consumers have no issue paying full price for tablets, which are essentially large smartphones with all the same features except placing calls. But carriers have been discounting the price of phones forever.

"It's a bad habit," said Craig Wigginton, leader of the U.S. Telecommunications sector at Deloitte. "There's the notion that this will be done in perpetuity."

Wigginton compared the wireless industry to airlines. It may only take one carrier to completely eliminate subsidies before the rest all follow. T-Mobile may be that first "airline" of wireless.

Carriers may gradually charge more for smartphones over the next two to three years, Wigginton said. They may first raise the price of a new phone to $250, then $300 and so-on.

So if you want the latest iPhone or Galaxy for $199, you may need to buy it sooner rather than later. ![]()

First Published: May 9, 2013: 10:08 AM ET