Click the chart for more market data.

NEW YORK (CNNMoney)

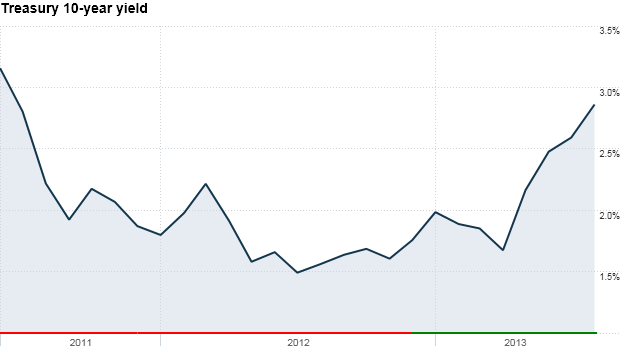

Worries that the central bank could taper its $85 billion a month in bond purchases, or quantitative easing, as early as September has spurred a huge sell-off in bonds.

Investors have yanked nearly $20 billion from bond mutual funds and exchange traded funds so far in August. That's the fourth highest pullback ever, according to TrimTabs data. In June, investors took out $69.1 billion -- the highest on record.

The heavy selling has pushed long-term bond rates to two-year highs, with the benchmark 10-year Treasury yield nearing 2.87%.

Click here for more on stocks, bonds, currencies and commodities

"As much as bond professionals say they've never really liked QE, they're trading as though they miss it already," said Jim Vogel, interest rate strategist at FTN Financial.

The Fed will remain in focus this week as investors look ahead to Wednesday. That's when the Fed releases minutes from its last monetary policy meeting. The Kansas City Fed also hosts its annual conference in Jackson Hole, Wyo. later this week.

Concerns about the Fed tapering have hit stocks as well. The Dow Jones industrial average, the S&P 500 and the Nasdaq have dropped for two consecutive weeks.

But with no economic data or significant earnings reports on tap Monday, the three major market indexes were only slightly higher.

Related: Fear & Greed Index

What's moving: Shares of Chesapeake Energy (CHK, Fortune 500)advanced following news that Carl Icahn boosted his stake in the natural gas company to almost 10%.

Apple, (AAPL, Fortune 500) which Icahn announced a "large" position in last week, also continued to move higher.

The earnings calendar was light Monday, but results are due from J.C. Penney (JCP, Fortune 500), Target (TGT, Fortune 500) and Hewlett-Packard (HPQ, Fortune 500) later in the week.

Related: Investors look to emerge from rough patch

World markets: European markets were slightly lower in afternoon trading.

Asian markets ended mixed results. Both the Shanghai Composite index and Japan's Nikkei rose nearly 1%. Stocks in Hong Kong declined by 0.3%. And investors are also nervously watching India, where stocks have plunged lately as the country's rupee currency hit an all-time low. ![]()

First Published: August 19, 2013: 9:51 AM ET

Anda sedang membaca artikel tentang

Bond bubble finally bursting? Rates creep up

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/08/bond-bubble-finally-bursting-rates.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Bond bubble finally bursting? Rates creep up

namun jangan lupa untuk meletakkan link

Bond bubble finally bursting? Rates creep up

sebagai sumbernya

0 komentar:

Posting Komentar