NEW YORK (CNNMoney) -- U.S. stocks opened little changed Friday as investors remain sidelined by political gridlock in Washington.

Investors have been grappling with uncertainty as lawmakers and President Obama engage in brinksmanship over year-end tax hikes and spending cuts. The so-called fiscal cliff could harm the economy at a time when the outlook for growth is already in question.

Economic data released Friday showed personal income remained unchanged in October, while spending declined by 0.2% in the month.

"That's a concern because the consumer has been a pillar of the economy," said Doug Cote, chief market strategist at ING Investment Management. "The numbers were clearly below consensus and the market didn't like that."

The Dow Jones industrial average, the S&P 500 and the Nasdaq all hovered near the break-even point.

Chicago's Purchasing Manager Index, a barometer of manufacturing activity in the area, is due shortly after trade begins.

Meanwhile, lawmakers in Congress have made "no substantive progress" in the fiscal cliff talks, Speaker John Boehner said Thursday. That came after Boehner said Wednesday that he's "optimistic" that a compromise will be reached "sooner rather than later."

Related: America's debt challenge

Despite the mixed signals, U.S. markets ended in positive territory on Thursday.

Few stocks made big moves in early trading Friday, though shares of St. Jude Medical (STJ, Fortune 500) were higher after the hospital's board authorized a $1 billion stock buyback. Yum! Brands (YUM, Fortune 500) sank after the firm softened its expectations for China, predicting same-store sales in that key market would decline 4% in the fourth quarter.

Zynga (ZNGA) shares slid 9% early Friday, after tumbling 13% after-hours Thursday on news that the terms of its deal with Facebook (FB) had substantially changed.

Fear & Greed Index

Research firm NPD Group reported sales of PCs running Microsoft (MSFT, Fortune 500) in the four weeks ended November 17 dropped 21% from the previous year. Microsoft released its new operating system, Windows 8, on October 26.

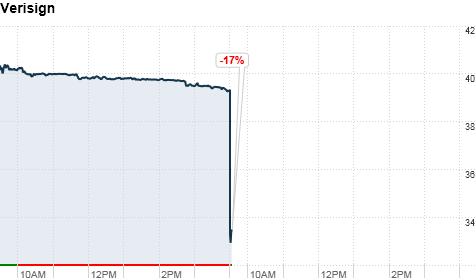

Verisign (VRSN), the company that makes money off the .com registration, said it reached a new agreement with the Commerce Department that bars future price increases.

Asian markets played catch-up Friday, but were also helped by the approval of a new stimulus package in Japan and expectations of strong Chinese factory data due over the weekend. Extending weekly gains, the Nikkei rose 0.48%, the Hang Seng advanced 0.49% and the Shanghai Composite jumped 0.85%.

European stocks were firmer in afternoon trade, despite news that eurozone unemployment hit a new record in October.

In other overseas news, the pace of economic growth in India slowed during the latest quarter. The country's GDP, the broadest measure of a nation's economic health, grew at a rate of 5.3%.

The dollar slipped against the euro, but was firmer against the British pound and Japanese yen. ![]()

First Published: November 30, 2012: 9:47 AM ET