NEW YORK (CNNMoney)

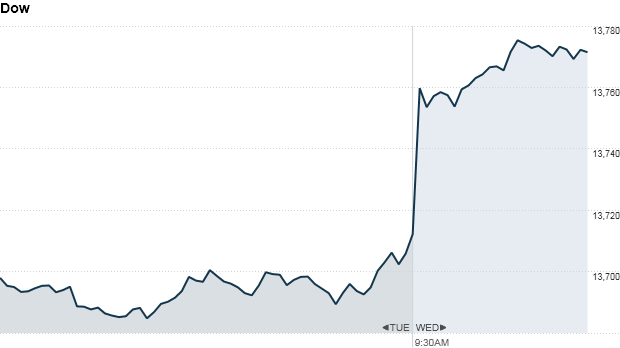

The Dow Jones industrial average fell 0.1% and the S&P 500 lost 0.2%. The Nasdaq was little changed.

The government reported a jump in initial jobless claims following two weeks of declines. Claims rose 38,000 to 368,000 in the latest week. Analysts were expecting 345,000 claims.

Separately, outplacement firm Challenger, Gray & Christmas reported the number of planned job cuts surged 24% to 40,430 in January.

Those figures are worrying ahead of the all-important monthly jobs report due Friday. Analysts are expecting that employers added 180,000 jobs in January, and that the unemployment rate ticked down to 7.7% from 7.8% in December.

Meanwhile, personal income in December rose 2.6%, while spending inched up 0.2%, according to the Commerce Department.

"This morning's data adds to our view that the economy is not accelerating," said Steven Ricchiuto, chief economist at Mizuho Securities.. "Instead, it is stuck on a shallow growth trajectory."

Thursday's reports come a day after the government reported a surprise drop in economic activity during the fourth quarter, although the GDP data contained some hints of underlying improvement.

Investors were also rattled Wednesday by the latest statement from the Federal Reserve, which said economic growth had paused.

Still, stocks have enjoyed a strong start to 2013.

Related: What's behind the bull market

The Dow is up more than 6% so far in January, while the S&P 500 has climbed 5% and the Nasdaq is up 4%. The Dow is just 2% away from its record high, hit in October 2007, while the S&P 500 is about 5% away from its record high, also reached in October 2007.

In corporate news Thursday, shares of UPS (UPS, Fortune 500) declined after the shipping giant's fourth-quarter earnings came in below of forecasts. The company's guidance for 2013 was also weaker-than-expected.

Shares of Dow Chemical (DOW, Fortune 500) also declined on an earnings miss.

Facebook (FB) shares dropped after the firm said late Wednesday that its fourth-quarter mobile user growth had slowed slightly versus the third quarter. Facebook's fourth-quarter earnings and sales beat Wall Street estimates.

Related: Fear & Greed index near record high

European markets were lower in afternoon trading as weak corporate earnings weighed on sentiment. Results from oil major Shell and drinks group Diageo (DEO) missed expectations, while Deutsche Bank (DB) posted a $3.5 billion quarterly loss on legal and restructuring charges. Telecoms equipment maker Ericsson bucked the trend, posting strong gains after beating expectations.

Asian markets ended mixed, with the Hang Seng slipping 0.4%. ![]()

First Published: January 31, 2013: 9:42 AM ET