There are a lot of meetings with engineers, chemists and geologists. There's a constantly evolving learning curve. And then there's all the regulations and compliance. But all-in-all it's pretty straight forward, that is, until the media gets a hold of it. That's when it becomes complicated.

It's as though we are getting reports from the mysteries of the deep ocean or life in the great galaxies beyond. There is so much hyperbole and unsupported guesswork that investors don't have a chance. So, in a small effort to set the record straight, let's see if we can't dispel some of the misinformation.

Related: Who will control the world's water supply?

Misperception #1: Goldman Sachs knows what is going on. This is incorrect. Goldman Sachs should not be quoted extensively. They are notoriously wrong when forecasting tops and bottoms. What they are good at is jumping on the band wagon and stoking fires.

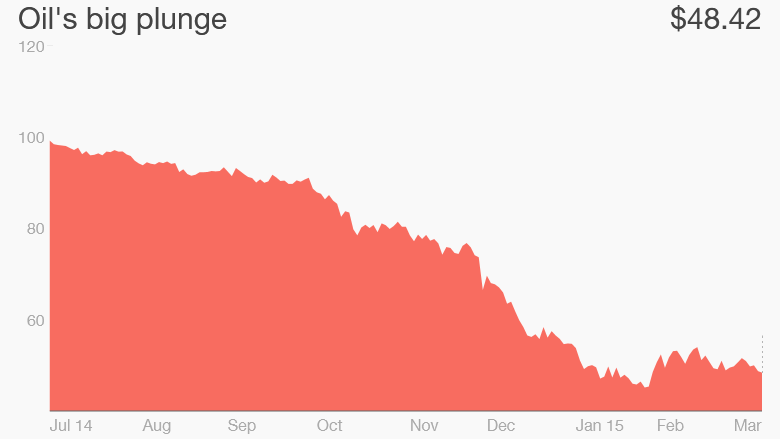

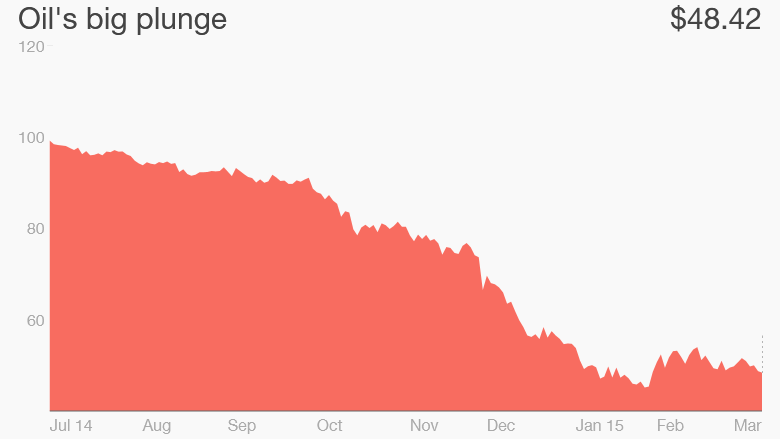

Their forecasting always seems to be done through a rear view mirror and their calls for peaks and troughs are always overdone. Back in July 2014 when WTI crude oil was peaking, they were calling for more, even as the dollar was showing signs of strength (and we know what happened there) and as oil inventories were beginning to wash up over our ankles. And then when we are forming a bottom in January and retesting it in March, they were calling for a deeper bottom.

And then there was 2008. Remember the calls for $150 and $200 oil from Goldman and Morgan Stanley? That was right before we went to $40 and then some. (To be fair, Ed Morse from Citi called the top but he overshot the bottom. We're not going into the $20s).

Related: U.K. makes a big oil discovery

Misperception #2: The "non-productive rigs" are the first to go. This statement is a little baffling because all drilling rigs are productive, some are just more efficient. Helmerich & Payne's Flex 4 and Flex 5 rigs are state of the art. But these rigs are stacking up just as fast as the less efficient rigs that require more man hours but are not as expensive to contract.

Have a drive past H&P's Odessa yard. It's stocked full of these Flex 4s. Rigs are enormous which makes them costly to move around. You're not going to bring in a dozen or so tractor trailers and a few cranes for a rig move back to Texas or Oklahoma, and hire the same sized fleet to bring in the newest generation rig. The closer truth is that the ones that are running in particular areas—that have not been let go—will continue running in those areas. And what the oil companies are going to do is put pricing pressure on their driller for not having supplied the cat's ass in the first place.

Related: How Much Longer Can OPEC Hold Out?

Misperception #3: Supply keeps coming on because of innovations in fracking. Yes, fracking has gotten much better in shale formations but the real advances are already baked in. What has been occurring over the last 24 months or so is that more sand is being run per stage and stage intervals are more densely packed. Other than some new chemistry and a few software updates, that is the bulk of it. There really is no smoking gun between well completions in July 2014 when oil was at $100 and now -- 9 months later -- when oil has been cut in half.

Misperception #4: Fracking has not gotten exponentially more efficient resulting in outsized cost reductions. Yes and no, but more "no" than "yes." The 600 lb gorilla in the room is competition. Fracking has gotten competitive, damned competitive. Five years ago fleet sizes were smaller and there were nowhere near as many players. But then came the boom and service companies did what they do best. They overbuilt. They were also cheered on by cheap and plentiful money because everyone, especially bankers and private equity, wanted in on this one. To get an idea of just how competitive the shale landscape has become, a stage in a 2012 Marcellus well fetched almost twice the same stage today. There have been multiple improvements in both design and implementation, but the heavy lifting on cheaper frack pricing has been competition.

Related: What happened to oil after the Iran 'deal'

Misperception #5: The Baker Hughes rig count has become irrelevant. Incorrect. The Baker Hughes rig count is always relevant. Remember, this was the weekly number that allowed us to hold a bottom at $43 in March. But because supply didn't immediately go lockstep with the falling count, analysts lost patience. They are now theorizing that rigs are so "productive" that the count no longer carries the weight that it once did.

That's a tough position to take. We were at 1,600 rigs drilling for oil in October and we're now at 800. There is some truth that E&Ps are now favoring sweet spots but that won't make up for the 50% collapse in the count. Shale extraction resembles an industrial process more than it does wildcatting. There aren't many dry holes with shale. Microseismic advances have put an end to that as have data rooms stuffed full of old well logs that chart the potential of shales. Thus, most shale wells drilled today have a much better chance of being economic than step out and exploratory wells of the past.

There is no legitimate model for 800 rigs growing U.S. production past 8.9 million barrels per day in the Lower 48. And because its shale, and because shale is "tight", drilling must continue at a breakneck pace to grow production. Analysts looking for a more 'spot on' number should start following the activity of fuel distributors who run nonstop between depots and frack jobs. Watch their sales for a more immediate indication of future production.

Related: Oil Rebound May Come Sooner Than Expected

Misperception #6: We are running out of storage space for crude. We're not. We're going to be OK. Volumes have increased, especially at the oft mentioned Cushing, but Cushing accounts for only about 10% of US storage. Other storage areas are up but nowhere near as much. The reason is that physical traders like to park their inventory close to market and Cushing gives them that proximity. Also, Cushing is not a dead end. There are large pipelines that connect it to the Gulf Coast where storage is more plentiful and not nearly as full. Additionally, large inventory draws will be coming shortly with the advent of warmer weather.

Misperception #7: Shale wells have a productive life of only a few years. The truth on this one is slowly being sorted out and commentators are finally getting it right. Shale lacks permeability. Which means it's very "tight". It requires a frack job to free up the oil and gas trapped in its pore space. Fracking creates and sustains permeability and permeability is the pathway to the wellbore.

Like any tight formation, oil and gas production is front loaded, meaning that most production will come right after stimulation. This results in excellent up front results but production tails off quickly, maybe even falling as much as 75% in year one and settling into something less for the next 10 or 20 years. This is called the tail and the tail is profitable, but only if the flush pays for most of the well.

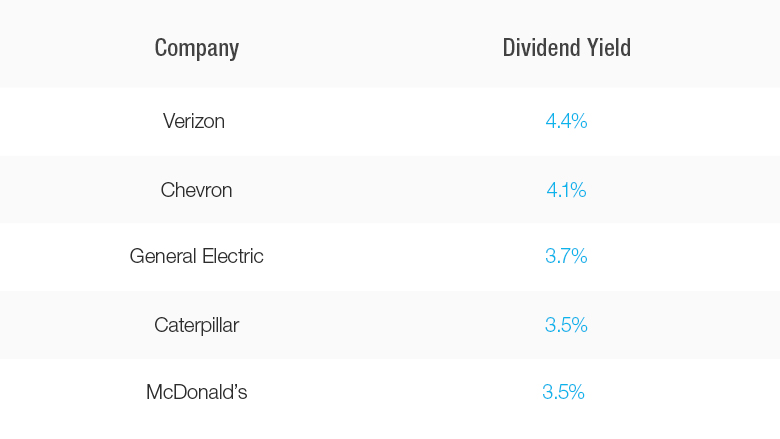

Related: GE stock up 8% on sale of GE Capital Unit for $26.5 billion

Misperception #8: You can turn shale on and off. That's wrong. Shale takes time like any other industrial activity. Slowing down its progress is a bit like stopping a supertanker. You can do it, but you need a lot of room. Most drillers require contracts and breaking them can be painful. Sand can pile up at rail sidings and result in demurrages. Layoffs can take time. Regulatory penalties may force an operator into activity whether he wants activity or not.

All this takes time to work out. And then there's always the stronger balance sheets that will drill regardless of price or that will drill and create a "fracklog" which is a newly minted MBA speak for a backlog of wells to frack. There is no switch you can flip.

Misperception #9: Oil is inversely related to the dollar. It is. This was a head fake. It's not a misperception. Match the DXY to Brent and WTI over the last 12 months. It's a perfect divergence. You want to bet on oil, then bet on the Euro.

Related: Why The Oil Price Collapse Is U.S. Shale's Fault

Misperception #10: OPEC is done. Maybe, but the Gulf Cooperation Council is not. Collectively, the 4 GCC members pump more than half of all OPEC production. They also have very low lifting costs and enormous cash reserves. Additionally, they have stamina and are going to maintain OPECs position of no cuts. There's a long history of Russia or Venezuela filling reduced quotas. This time around the GCC is not going to let that happen. If Russia concedes there may be a cut in June. But it is looking unlikely even if they do. Look for Saudi Arabia to pick up market share.

Misperception #11: American shale producers are the new swing producers. No, their banks are.

Misperception #12: A deal with Iran will lower prices. Sort of. It will take Iran a year or two to add anything meaningful to our 93 million barrels a day global market but the fear of a nuclear Iran will create enough tension to offset the supply addition. Worries over a nuclear Iran, whether real or perceived, will create enough fear in the markets to more than counter balance the additional million barrels a day of supply that may come on.

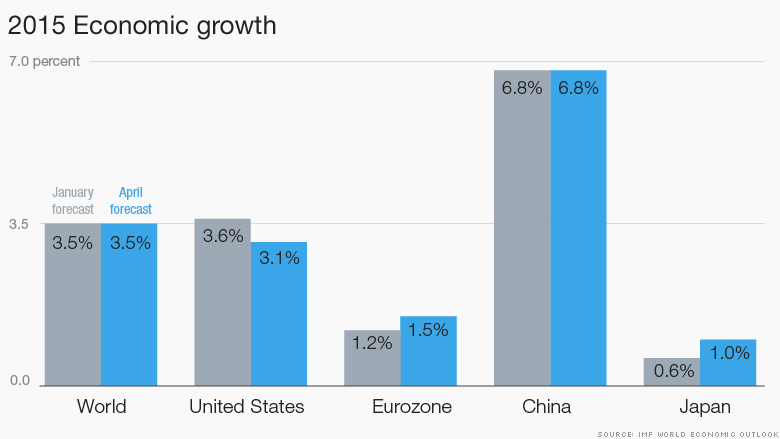

In short, oil prices will increase as weekly EIA production numbers begin posting declines as we saw last week. Demand will increase. Inventories will start getting eaten into by midyear. Europe will contribute as will Asia and the Middle East. A shrinking Chinese market is still growing at 7% a year, and that market is much bigger now than when it was posting 10% yearly growth five years ago.

Rich Kinder was right in calling the bottom in the low 40s and John Hofmeiser (former President of Shell Oil) and T. Boone Pickens are probably pretty close to being right with their call of $80 as the top in the next year or so. A solid $65 to $70 by year end is the more reasonable number and is just enough to hold off development of some offshore projects, oil sands work and a good amount of the non-core shale plays.

A stronger dollar will also do its work here as will a Saudi Arabia hell bent on market share. There will be less and less for shorts to hold onto and very few will want to be stuck on the same side of the trade as the big investment banks.

Dan Doyle is president of Reliance Well Services, a hydraulic fracturing company based in Pennsylvania. He wrote this piece for Oilprice.com.

Related: U.S. gas prices to remain low through the summer

(New York) April 10, 2015: 11:05 AM ET

Capital New York editor Josh Benson in the newsroom in 2013.

Capital New York editor Josh Benson in the newsroom in 2013.

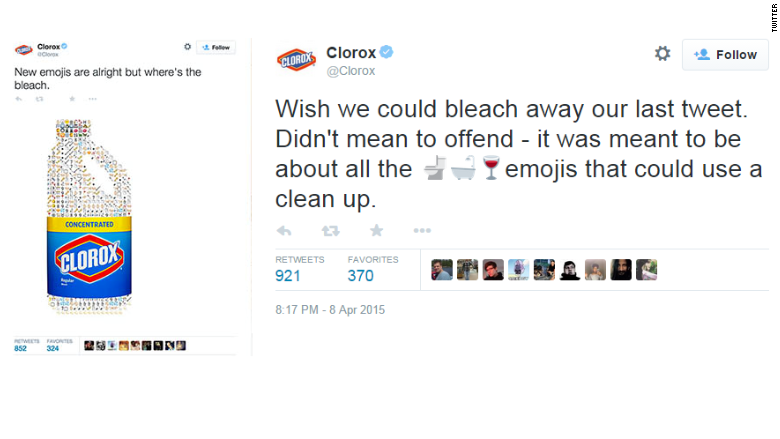

Apple hates these people.

Apple hates these people.

John Dickerson has been the political director for CBS News since 2011.

John Dickerson has been the political director for CBS News since 2011.  John Travolta isn't interested in watching HBO's Scientology documentary 'Going Clear.'

John Travolta isn't interested in watching HBO's Scientology documentary 'Going Clear.'  President Obama and First Lady Michelle Obama reported about the same amount of income in 2014 as they did in 2013.

President Obama and First Lady Michelle Obama reported about the same amount of income in 2014 as they did in 2013.  Russia might soon get its own

Russia might soon get its own

Universal's "Furious 7" had a big US debut at the box office, but also broke records around the world.

Universal's "Furious 7" had a big US debut at the box office, but also broke records around the world.