Selling brands on Facebook

Written By limadu on Kamis, 28 Februari 2013 | 22.16

Guggenheim is flexing its $170 billion muscles

Todd Boehly (left) and Mark Walter at Guggenheim's New York offices

(Fortune)

Fittingly enough, the winner was a charismatic superstar with local pedigree: retired Los Angeles Lakers legend Magic Johnson. Or rather, the victors were, as the headlines typically put it, "a team led by Magic Johnson." Sports fans across the country gasped at the audacious size of the triumphant bid: $2.15 billion. That sum obliterated the next highest reported offer, from Cohen, by a staggering $850 million. The difference between the two bids was larger than the previous record for a baseball club: $845 million for the Chicago Cubs in 2009.

The team "behind" Magic Johnson -- Guggenheim Partners -- turned out to be the main force in the deal, and the eye-popping Dodgers acquisition has been only one of a handful drawing ever more attention to the firm. The New York- and Chicago-based operation has been turning up everywhere in Los Angeles. In September, a Guggenheim group spent a reported $370 million for Dick Clark Productions, the company that produces the Golden Globes telecast and So You Think You Can Dance. A few years before, Guggenheim teamed up with other investors to buy seven trade publications, including the Hollywood Reporter.

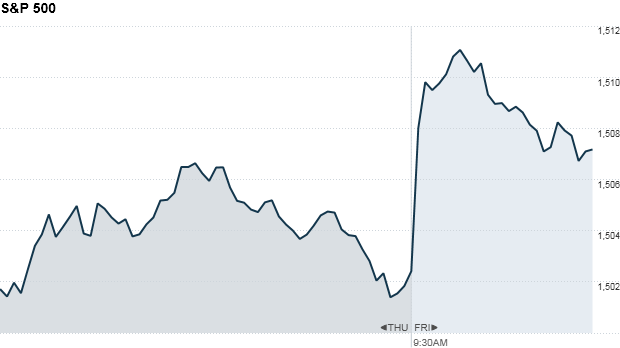

Dow marches toward record high

NEW YORK (CNNMoney)

The Dow Jones industrial average rose 0.2%, the S&P 500 added 0.3% and the Nasdaq gained 0.4%.

While jobless claims fell sharply last week, the government's second estimate of fourth-quarter GDP showed a nearly imperceptible gain of 0.1%. The revised reading ell short of the 0.5% growth economists were expecting.

Thursday marks the last trading day of February, which has largely been a dud for stocks. But following a massive rally in January, it hasn't been a surprise for stocks to pull back.

Even with the sluggish trading this month, all three indexes are still up roughly 6% to 7% for the year. The Dow is within 67 points, or 0.5%, of its all-time high, set in October 2007. The S&P 500 is just 3% away from its record high, also set in October 2007

U.S. stocks have rallied for the previous two sessions after Fed Chairman Ben Bernanke signaled to lawmakers that the central bank's easy money policies would remain in place for the foreseeable future.

On the corporate front, Barnes & Noble (BKS, Fortune 500) shares edged lower after the bookseller reported a 9% drop in quarterly sales and a net loss of $6 million. The company said that its Nook sales plummeted 26% compared with the year-ago quarter.

Department store chain Sears Holdings Corp (SHLD, Fortune 500) reported sales at stores open a year or more notched up 0.8% in the fourth quarter but fell 1.4% for the year. The company said that it has closed 300 Sears and Kmart stores, or 13% of its total, since 2006. Shares declined more than 1%.

Related: Fear & Greed Index back in greed

J.C. Penney (JCP, Fortune 500) shares tumbled after the retailer reported a dismal fourth-quarter loss and weak same-store sales.

Groupon (GRPN) shares plunged after the daily deals site's results missed already low expectations.

Shares of Sturm, Ruger & Co. (RGR) slipped even after the gun maker reported earnings that beat expectation. The company benefited from a surge in firearm sales on growing fears of new gun-control laws following the re-election of President Obama and the shooting in Newtown, Conn.

Clothing retailer Gap (GPS, Fortune 500) is on tap to report earning after the bell.

European markets were mostly higher in afternoon trading, drawing support from comments from European Central Bank President Mario Draghi that suggested the bank had room to relax policy further. Meanwhile, the European Union is planning to cap bankers' bonuses to rein in reckless risk taking.

Asian markets had a banner day. After the nomination of Haruhiko Kuroda to be Japan's next central banker, the Nikkei posted a 2.7% increase to its highest point since 2008. The Shanghai Composite rose 2.3% and the Hang Seng added 2%.

The dollar rose agaisnt the euro and the Japanese yen, but fell versus the British pound.

Oil priced rose slightly, while gold slipped.

The price on the 10-year Treasury rose, pushing the yield down to 1.89% from 1.90% late Wednesday. ![]()

First Published: February 28, 2013: 9:56 AM ET

Guggenheim is flexing its $170 billion muscles

Written By limadu on Rabu, 27 Februari 2013 | 22.16

Todd Boehly (left) and Mark Walter at Guggenheim's New York offices

(Fortune)

Fittingly enough, the winner was a charismatic superstar with local pedigree: retired Los Angeles Lakers legend Magic Johnson. Or rather, the victors were, as the headlines typically put it, "a team led by Magic Johnson." Sports fans across the country gasped at the audacious size of the triumphant bid: $2.15 billion. That sum obliterated the next highest reported offer, from Cohen, by a staggering $850 million. The difference between the two bids was larger than the previous record for a baseball club: $845 million for the Chicago Cubs in 2009.

The team "behind" Magic Johnson -- Guggenheim Partners -- turned out to be the main force in the deal, and the eye-popping Dodgers acquisition has been only one of a handful drawing ever more attention to the firm. The New York- and Chicago-based operation has been turning up everywhere in Los Angeles. In September, a Guggenheim group spent a reported $370 million for Dick Clark Productions, the company that produces the Golden Globes telecast and So You Think You Can Dance. A few years before, Guggenheim teamed up with other investors to buy seven trade publications, including the Hollywood Reporter.

Lately, Guggenheim has turned its sights on another crown jewel: AEG, which billionaire Philip Anschutz has put on sale for $10 billion. AEG owns the L.A. Live entertainment development, hockey's L.A. Kings, and a global concert promotion division. It also owns the Staples Center, where the Lakers play, and developed the site that is expected to attract an NFL team to L.A. Guggenheim is considered the favorite for AEG, though there are hints, as we'll see, that it may bow out of the bidding.

The secret is out: Guggenheim is a powerhouse on the prowl. What not that long ago was a small office overseeing a venerable family fortune has burgeoned into something much different and much bigger. Guggenheim now manages $170 billion for institutions, individuals, and insurance companies. It runs several hedge funds and an investment bank. Another part -- the one that makes headlines -- is akin to a private equity firm. It gathers investors on a deal-by-deal basis (rather than raising war chests that it can deploy over a period of years) to fund giant purchases such as the Dodgers.

MORE: 2012 sports endorsement stars (and 2013 prospects)

Guggenheim is an anomaly if ever there was one. It's a firm whose name is instantly recognizable to anybody who has ever heard of the Guggenheim Museum and its swirling New York City building, designed by Frank Lloyd Wright. It has hired a coterie of business luminaries, such as former Bear Stearns CEO Alan Schwartz and Cendant founder Henry Silverman, who are familiar figures to readers of the financial press. But it has preferred to operate out of the spotlight and what it does is a mystery to most people.

Its secretiveness is partly strategic and partly a reflection of the reserved, stolid personality of Guggenheim's CEO, Mark Walter. He has focused on managing the rapidly expanding firm, while its more frenetic president, Todd Boehly, has been driving the glitzy new deals. "They want to be the dark horse in the shadows," says a former employee.

But Guggenheim also knows it's growing too large to escape scrutiny. It's one thing to manage portfolios for discreet, wealthy clients. It's quite another to scoop up high-profile businesses with intense fans and media coverage.

And one prominent client -- former junk bond king Michael Milken -- is bringing the firm unwanted attention. Fortune has learned that the Securities and Exchange Commission is investigating his dealings with the firm and whether they violate Milken's ban from the securities industry.

As it attracts more notice, Guggenheim is finally openings its doors -- just a crack -- meeting in February for an exclusive interview with Fortune. Among the crucial questions: Is Guggenheim the latest hot investment outfit looking to flip companies? Or is it shaping up to be something more, a conglomerate with dozens of profitable long-term businesses that aspires to be a sort of Hollywood equivalent of Berkshire Hathaway (BRKA, Fortune 500)? "This is not a company whose plan is to sell everything next week or next year," says Walter, a model of politeness who nonetheless dribbles out information as if he were a parched desert traveler tightly clutching a canteen with its last few drops of water. Observes one consultant: "Everyone is scratching their head a little bit asking, What are they trying to do?"

MORE: Ron Howard and Brian Grazer take on advertising

The Guggenheim family fortune dates back to 1881, when Meyer Guggenheim paid $5,000 for a stake in two Colorado lead and silver mines. Within a few decades his seven sons had amassed huge riches, with operations from the Yukon to Bolivia. They became one of the most prominent German Jewish families in New York, according to the history Our Crowd, well before Meyer's son Solomon gave the Guggenheims a measure of immortality by founding the museum that bears their name on Manhattan's Fifth Avenue.

Like other ultrarich families, the Guggenheims managed their assets through a family office. That operation chugged along until the late 1990s, when a friend named J. Todd Morley proposed transforming the family firm into something bigger and more ambitious. Morley headed a fixed-income trading company and had gotten to know Mark Walter, who ran a multibillion-dollar business called Liberty Hampshire that structured asset-backed securities. Morley advocated combining all three operations.

The new Guggenheim Partners would invest in various forms of structured debt, which were then taking off, and they'd use the name to attract more investors. "We had the idea that a powerful brand would launch our marketing," Morley recalls. The family accepted.

The new entity opened in 1999 with $5 billion under management. Two years later Walter hired Boehly, a former Credit Suisse First Boston banker who brought with him a successful leveraged-finance team that traded loans and junk bonds.

MORE: Don Yacktman - fund manager's faith produces results

One of Guggenheim's earliest clients was Sammons Enterprises, a Dallas conglomerate that controls several insurers. Today Sammons owns 35% of Guggenheim, whose employees own just under 50%, including stakes of under 10% each for Walter and Boehly. The Guggenheim family retains a small percentage.

Other clients included a passel of small and midsize insurers without the resources to invest their own assets. They benefited as Guggenheim's bond strategies thrived. For example, the core fixed-income accounts run by CIO Scott Minerd -- a former competitive bodybuilder in the superheavyweight division -- returned 7.3% annually from 1999 through 2012.

That stellar performance attracted a flood of assets, especially from insurers. If you tally up the money Guggenheim manages for insurers (including some the firm has now bought), it totals $75 billion today.

Guggenheim's rapid growth in assets under management -- from $5 billion to $170 billion in 14 years -- is a tribute to the steady hand of CEO Walter. Trim and silver-haired, Walter, 52, is the picture of Midwestern diffidence, the sort of dependable guy you'd imagine running your local bank if Frank Capra were making movies today. Walter, who grew up in rural Iowa with parents who never made it to college, avoids the spotlight so assiduously that he confesses that his conversation with Fortune is only his third formal interview ever. He is circumspect and thoughtful.

By contrast, Boehly, a Maryland state wrestling champion in high school, is a whirl of energy. With disheveled hair -- he has a few unruly forelocks he can't tame even at the best of times -- and wrinkled shirts, at 39 he still resembles a boy forced to wear proper adult clothing. "He doesn't look like an executive," says a former colleague. But Boehly's appearance belies his role. He is Guggenheim's chief dealmaker.

Friends say he's a workaholic. Boehly leaves the impression of a supercaffeinated man juggling dozens of projects, interrupting himself midsentence to interject an observation about another deal. He would call friends from Greece at 6:30 a.m. during the European debt crisis to talk about opportunities, oblivious to the fact that it was 11:30 p.m. in New York. "It's nice to have a partner who is working constantly," says Walter with typical understatement.

MORE: Mutual fund managers could be tomorrow's buyout kings

For all their difference in temperament, Boehly and Walter share one ambition. "These guys want to be billionaires," says a former colleague. And while their roles complement each other -- Walter is the wise older sibling and Boehly the manic idea man -- it is Boehly who is propelling the firm into new terrain. "I don't think Mark was looking to set the world on fire," says someone close to Guggenheim. "I think Todd has helped kind of ignite that."

Boehly is also the person who brought Guggenheim its most intriguing client. Nearly a decade ago he met Michael Milken through a friend. "Milken is an idol of sorts to Boehly," says a former colleague. ("When I was young, I read lots of books on people," says Boehly. "Mike is no more of an idol than Steve Jobs, Ben Franklin, or Mark Twain.") In past years Milken would sometimes speak to Boehly several times a week about markets, companies, and philanpthropy. Boehly is active in Milken's prostate cancer foundation.

The relationship has been lucrative for both men. Milken was an early investor in Boehly's hedge fund. At one point Milken had nearly $800 million invested in various Guggenheim funds and deals. (Milken's worth is $2.3 billion, according to Forbes.) In one instance, Milken and Guggenheim jointly invested in an energy company called Milagro, which says the infusion helped it buy the Gulf Coast operations of Petrohawk Energy for $825 million in 2007.

Milken's settlement with the SEC for his role in the 1980s Wall Street scandals allows him to manage his own money. But he is banned from acting as an investment adviser or broker. Milken violated the ban in the '90s, according to the SEC, when he advised Ron Perelman and Rupert Murdoch on deals. In 1998 Milken settled the SEC's claim for $47 million without admitting or denying wrongdoing.

MORE: Does Warren Buffett still hate private equity?

Fortune has learned the SEC is investigating Milken's relationship with Guggenheim, specifically the question of whether he is violating his ban by effectively acting as a manager of Guggenheim investments beyond his own. The question is: Does Milken provide advice in exchange for some form of compensation? The SEC is looking at a number of transactions that Milken has done with Guggenheim, including the Milagro deal.

Boehly has been subpoenaed by the SEC, and the firm has provided thousands of trading records and e-mails to investigators. The agency has contacted Guggenheim clients about Milken. SEC investigators are in regular communication with Guggenheim, but so far the probe -- which has continued for two years -- hasn't resulted in any formal action.

Walter says, "Mike doesn't have an ownership or managerial role in the firm in any way, shape, or form." A spokesperson for Milken provided a statement noting that with regard to the advice he gave that led to his 1998 settlement with the SEC, Milken had been advised by his attorney that he was permitted to engage in those specific consulting transactions. Today, the statement continued, "he does spend time on his and his family's personal investments, including working with many investment advisors and money managers. He discusses investments with these advisors from time to time, but only as an investor of his own funds and those of his family." An SEC spokesperson declined to comment.

Guggenheim had enjoyed huge success managing assets for insurers. Eventually Walter and Boehly found themselves with a new opportunity: to buy some underpriced insurers. That also offered a bonus -- they could gain even more investing capital. They'd be able to tap the "float," the billions insurers hold in between receiving premiums and paying out claims. Warren Buffett has become fabulously rich doing this.

MORE: Hollywood talent agency CAA forming VC fund

Guggenheim had been cautious enough to avoid the cataclysm of the financial crisis. So when disaster struck and asset prices plummeted, it pounced. "When that opportunity came to us," Boehly says, "we were just well positioned."

In 2009, Guggenheim bought Wellmark Community Insurance. A year later it and other investors spent $400 million for control of Security Benefit, and $470 million to buy life insurer EquiTrust in 2011. Last year a Canadian insurer sold its U.S. annuities business to Guggenheim for $800 million. The firm also acquired two companies, Claymore and Rydex, that sell exchange-traded funds.

Guggenheim was building a base of capital to use for potential deals. It wouldn't take long for Walter and Boehly to use it.

These days Boehly is most excited about the potential of live events. Sports, concerts, awards shows -- these primetime happenings, he believes, will continue to draw huge viewership and ad revenue despite splintered TV audiences. "As the world becomes more and more fragmented, and content becomes more and more commoditized, that premium content is only going to be become more valuable," says Boehly.

The Dodgers hit Boehly's sweet spot: a live events business that Guggenheim could buy using its insurance assets and those of its clients. Boehly and Walter had been skeptical when former Braves president Stan Kasten first floated the idea of buying a baseball team.

But when news broke in 2011 that the Dodgers would go on the block, Guggenheim zeroed in on a crucial detail: The team's TV deal was expiring after the 2013 season. Many people believed a new contract might bring in $3.5 billion over its lifetime. Boehly thought that figure was ludicrously low. Every other top L.A. team had locked up TV rights until 2031. Time Warner Cable and Fox Sports were likely to offer huge sums for the Dodgers rights.

MORE: 5 tech turnarounds that actually worked

Guggenheim put together an ad hoc ownership group (a practice the firm adopted in its early years because it didn't have much capital and then grew comfortable with the process). Walter, Boehly, and a Texas energy investor and client named Bobby Patton each contributed $100 million. Magic Johnson added $50 million, while movie producer Peter Guber kicked in $25 million. The remaining $1.2 billion came from insurance assets managed by Guggenheim.

That news sparked a firestorm in the press, which also mocked Guggenheim for overpaying. How could heavily regulated insurers invest in something as risky as a sports team? Never mind that insurance companies invest with, say, hedge funds all the time. The truth is elite sports teams are historically stable investments: They rarely lose their value and offer dependable cash flows from beer and ticket sales and media rights.

In January the firm enjoyed a moment of sweet vindication. The TV rights once expected to fetch $3.5 billion went for twice that amount. Time Warner Cable (TWC, Fortune 500) is reportedly set to pay $7 billion over 25 years for a new Dodgers sports network, created by Guggenheim, called SportsNet L.A.

Despite that success, Guggenheim may pull out of the bidding for another huge deal -- for the AEG sports and concert conglomerate, whose properties fit right into Boehly's biggest investment theme. Guggenheim has been viewed as the leading suitor. But it has recently backed off, according to people close to the negotiations. The price tag of $8 billion to $10 billion may be too much for Guggenheim to stomach. The situation could change, but right now Guggenheim is no longer the front-runner.

Meanwhile, the firm is still on the hunt for deals. It wants to add insurance assets and bolster its live events business. In January it hired former Yahoo (YHOO, Fortune 500) CEO Ross Levinsohn to lead a new operation that includes its magazines and TV production company. What Guggenheim will do with these businesses over the long-term is still up in the air. Whatever it does, it won't be under the radar any longer.

This story is from the March 18, 2013 issue of Fortune. ![]()

First Published: February 27, 2013: 9:55 AM ET

Yahoo defends no-work-at-home policy

NEW YORK (CNNMoney)

"This isn't a broad industry view on working from home -- this is about what is right for Yahoo, right now," said a statement from a company spokesman late Tuesday.

The no-work-at-home policy has prompted widespread criticism since it was unveiled in an e-mail to employees on Monday from Jackie Reses, the new head of human resources at the company who was brought in by CEO Marissa Mayer.

"To become the absolute best place to work, communication and collaboration will be important, so we need to be working side-by-side," said the e-mail. "That is why it is critical that we are all present in our offices."

Yahoo (YHOO, Fortune 500) did not say how many of the 11,500 employees currently work from home full time, saying it won't comment on "internal matters."

Many have criticized the move as damaging to morale, saying it could even chase away valuable employees.

"We like to give people the freedom to work where they want, safe in the knowledge that they have the drive and expertise to perform excellently, whether they're at their desk or in their kitchen," wrote Virgin Group CEO Richard Branson on his blog. "Yours truly has never worked out of an office, and never will."

Others have said that even if there is justification for the policy, the way it was announced, in an e-mail and without comment from Mayer or other executives, was a mistake.

"The new HR policy is shocking in its extreme measure and harsh delivery," wrote Fortune's Patricia Sellers. "The main problem is how the new rule got communicated."

--CNNMoney's Julianne Pepitone contributed to this story. ![]()

First Published: February 27, 2013: 8:20 AM ET

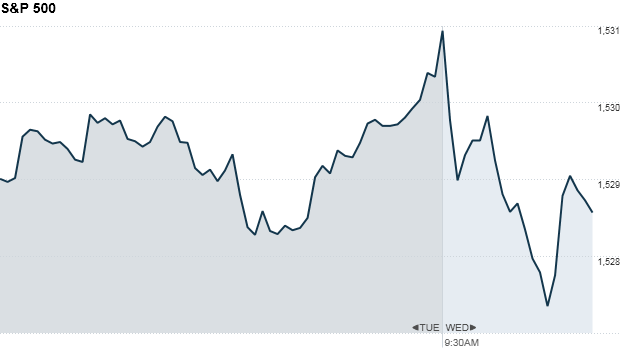

Stocks: Investors step back

NEW YORK (CNNMoney)

The Dow Jones industrial average and the S&P 500 were both down less than 0.1%. The Nasdaq was flat.

Stocks rebounded Tuesday after Federal Reserve chairman Ben Bernanke signaled the central bank's easy money policies will remain in force. That came a day after the Dow and S&P 500 suffered their worst one-day declines of the year.

The tone was more subdued Wednesday as investors responded to a report on new orders for long-lasting goods and a successful bond auction by the shaky Italian government.

The U.S. Census Bureau said durable goods orders dropped $11.8 billion, or 5.2%, in January. This was a steeper decline that the decrease of 3.5% projected by a consensus of economists surveyed by Briefing.com.

The Dreamliner issues with Boeing (BA, Fortune 500) and the drying up of defense spending appear to have played a role. Excluding transportation, new orders would have increased 1.9%.

Overall, the durable goods data were "far better than the headline decline suggests," said Paul Ashworth, chief U.S. economist at Capital Economics.

Meanwhile, a bond auction in Italy drew solid demand for €6.5 billion worth of medium and long-term debt. That helped push European markets higher.

Italy has been a concern for investors since elections over the weekend raised concerns about the government's commitment to economic reforms.

In Washington, Bernanke will be back on Capital Hill to give testimony before the House Financial Services Committee.

Investors will pay close attention to Q&A portion of the testimony, since Bernanke's written testimony is verbatim to what he delivered Tuesday, notes Marc Chandler of Brown Brothers Harriman.

On Tuesday, Bernanke urged lawmakers to prevent $85 billion in automatic spending cuts set to take effect Friday under the so-called budget sequester. He said the cuts would be a "significant" burden to the already tepid economy.

Related: The myth of the Great Rotation

In the U.S., investors are likely to be more focused on Apple's (APPL) annual shareholders meeting.

Firms including retailer TJX (TJX, Fortune 500) are scheduled to report quarterly results in the morning, while Sturm Ruger (RGR),Groupon (GRPN) andJ.C. Penney (JCP, Fortune 500) are up after the bell.

Related: Fear & Greed Index edging toward neutral

Shares of Priceline (PCLN) rose after the online travel site beat profit forecasts.

First Solar (FSLR) shares sank sharply after the renewable energy firm missed sales forecasts.

Related: Defense stocks in the crosshairs

Asian markets ended mixed. Japan's Nikkei lost 1.3%, while the Shanghai Composite added 0.9% and Hong Kong's Hang Seng increased 0.2%. ![]()

First Published: February 27, 2013: 9:38 AM ET

Stocks bounce back

Written By limadu on Selasa, 26 Februari 2013 | 22.16

NEW YORK (CNNMoney)

The Dow Jones Industrial Average, the S&P 500 and the Nasdaq gained between 0.3% and 0.6%.

The S&P Case-Shiller home price index for the fourth quarter of 2012 showed that home prices jumped 7.3%, the third straight quarter of year-over-year gains in prices.

At 10 a.m. ET, the Conference Board will release its consumer confidence index and the Census Bureau will release data on new home sales.

In corporate news,department store chain Macy' (M, Fortune 500)reported net sales jumped in the fourth quarter, to $9.4 billion from a year earlier. The company also said that same-store sales rose 3.7% for the year, edging out its initial forecast of a 3.5% gain.

Home improvement retailer Home Depot (HD, Fortune 500) reported strong year-end results, providing more evidence of a housing rebound. The company reported a 7% gain in same-store sales for the fourth quarter.

Related: World markets on edge over Italy

An Italian election that failed to produce a clear winner whipsawed U.S. stocks Monday, with the Dow and S&P 500 suffering their biggest one-day declines of the year.

Election results released by the Italian government late Monday showed a narrow victory for the center-left coalition headed by Pier Luigi Bersani in the lower house of parliament.

But former Prime Minister Silvio Berlusconi and other anti-austerity parties were not far behind, and the results pointed to gridlock in the Italian Senate. According to Bloomberg, Berlusconi is weighing an alliance that could break the gridlock.

Investors around the world are wary that stalemate in the Italian Senate could undermine the progress Italy has made in overhauling its troubled economy.

Related: Fear & Greed Index shifts into neutral

European markets were down more than 1% in afternoon trading, following Asian markets which closed lower.

The Hang Seng in Hong Kong fell 1.3%, while the Nikkei in Tokyo dropped 2.3% and the Shanghai Composite lost 1.4%.

Oil prices dropped, while gold prices rose. The U.S. dollar fell versus the euro, the British pound, and the Japanese yen.

The yield on the 10-year Treasury note edged lower to 1.89%, from 1.97% previously. ![]()

First Published: February 26, 2013: 9:56 AM ET

Budget cuts: I'm losing my job next week

On March 9, Raymond Wyrick will lose his job as a mechanic refurbishing Humvees for the U.S. Army, if federal budget cuts kick in this Friday.

WASHINGTON (CNNMoney)

As Washington continues to wrangle over the cuts, Wyrick is one of 414 workers in Texarkana, Texas, who are preparing to join the unemployment rolls.

The Red River Army Depot, where Wyrick and his fellow workers refurbish military vehicles, stands to lose $600 million from its budget starting this Friday.

A Humvee mechanic, 38-year-old Wyrick has worked at the depot for five years and makes about $47,000 a year. He worries about what it will mean for his family of three.

"I don't know how we're going to make it," said Wyrick, whose last day at work is March 9.

The depot is cutting 10% of its workforce of 4,000. The layoffs started on Feb 23. The rest of the employees will face furloughs, according to Cebron O'Bier, president of the union at the depot.

"Right now, the morale is way down. People are going into a panic, they don't know what they're going to do," Wyrick said.

He is on the front line of the forced spending cuts that will slash budgets of federal agencies. Most of the 2.1 million federal workers face furloughs.

CNN.com: Spending cut countdown

Roughly half of the cuts will come at the Pentagon -- most of its 800,000 civilian workers would start furloughs in late April.

Employees like Wyrick are among some 46,000 temporary or contract workers losing jobs nationwide, the Pentagon has said. And, like Wyrick, many of them work full-time with benefits, even though they're employed for a specific period of time and purpose. Since their jobs depend upon contracts being renewed, they're particularly vulnerable to budget cuts.

Pentagon spokeswoman Army Lt. Col. Elizabeth Robbins said agency officials regret the layoffs and are "deeply concerned about the effects of these actions on our military readiness, as well as the immediate effects on our civilian colleagues and their families."

Related: 7 budget cuts you'll really feel

The Red River Army Depot workers are puzzled over the cutbacks, because they say they save money for the Pentagon. By refurbishing older, war-torn vehicles they lead to fewer purchases of new cars and trucks for the Army.

"We overhaul various military vehicles, take them down to the smallest possible piece of material, refurbish them, and put them back together as good as a brand new vehicle," union president O'Bier said.

The depot is also a major economic force for the West Arkansas and East Texas area, where it is located. Employment gains at the depot helped the area rebound faster than other metropolitan areas in the region, said Kathy Deck, an economist and director of the Center for Business and Economic Research at University of Arkansas.

The unemployment rate in Texarkana was 5.7% in December, compared with the 7.8% unemployment rate nationwide, according to Bureau of Labor Statistics. Cuts at the Red River Army Depot will resonate throughout area restaurants, shops and other businesses, Deck said.

The loss will upend Wyrick's life. He's unsure if unemployment benefits will be enough to cover his home mortgage and insurance payments, not to mention basics like food and gas.

Wyrick found out that a local tire manufacturer he was hoping to ask for a job isn't hiring either. The company is cutting back because it's losing orders from the depot.

Now, Wyrick says he's looking into federal contractors who hire mechanics to work overseas.

"I grew up here and and have lived here my whole life, so a move overseas would be pretty drastic, you know, pretty drastic," Wyrick said. ![]()

First Published: February 26, 2013: 8:14 AM ET

Home prices shoot higher

NEW YORK (CNNMoney)

The report covered home prices across 20 major housing markets and comes ahead of a government report on the sales of new homes due later Tuesday.

The home price increase marks the third straight quarter of year-over-year gains.

The improvement is driven by many factors, including near record-low mortgage rates, a drop in the number of home foreclosures, a tight supply of homes available for sale, and an improvement in the overall economy, including a lower unemployment rate.

The resulting rise in home prices was the biggest annual increase since the second quarter of 2006, near the height of the housing boom.

But housing may not be able to continue to grow at this rate.

"These movements, combined with other housing data, suggest that while housing is on the upswing, some of the strongest numbers may have already been seen," said David M. Blitzer, chairman of the index committee at S&P Dow Jones Indices.

Cooper Howes, U.S, economist for Barclays, said that even if growth slows, there's no sign of a new housing bubble.

"We don't think we're at the point where we have to talk about overheating," he said. "The numbers are strong, but that's just coming off a really low base."

Barclays is forecasting a 6% to 7% price gain this year, and 5% to 6% in 2014.

Related: Housing - how to play the rebound

The rise in home prices can provide a lift for the economy as it increases household wealth and allows homeowners who had previously owed more than their homes were worth to refinance their mortgages, putting more money in their pockets.

"This 'wealth effect' will play a significant role in supporting consumer spending this year," said Joseph LaVorgna, chief U.S. economist for Deutsche Bank.

The increase was broad-based, with 19 of the 20 markets showing gains in December. New York posted the only decline, with prices edging down 0.5% from a year earlier.

Some of the markets with the biggest rise were those hurt the worst by the bursting of the housing bubble in six years ago -- prices jumped 23% Phoenix, 14.4% in San Francisco, nearly 13% in Las Vegas and just over 10% in Miami and Los Angeles. Detroit enjoyed a 13.6% rebound in prices.

Richard Green of the USC Lusk Center for Real Estate, said the recovery in housing prices hasn't been even across all the different price segments. He said the upper end of the market has done well as the wealthier families' earnings have recovered and foreign buyers have come into the market. The lower end of the market has recovered due to purchases by investors looking for bargains.

"It's the middle market that needs help -- particularly in the form of higher income -- if it is going to have a sustained recovery," Green said.

![]()

First Published: February 26, 2013: 9:10 AM ET

Adoption tax credit for same-sex couples

Written By limadu on Senin, 25 Februari 2013 | 22.16

Sharon McGowan, left, and her wife Emily expect to receive an adoption tax credit of more than $2,000 after Sharon legally adopted their daughter.

NEW YORK (CNNMoney)

The adoption tax credit grants qualifying taxpayers up to $12,650 per child for qualifying expenses. Opposite-sex married couples can claim it when they adopt a child together, but when one spouse adopts the child of his or her spouse, they don't qualify.

But under the Defense of Marriage Act, same-sex couples aren't recognized as married in the eyes of the federal government and therefore can qualify for the credit when adopting a partner's child, known as a second parent adoption.

Qualifying expenses include legal fees and court costs, which typically run from $1,500 to $2,500, along with a fee of around $1,200 for a home study -- a screening process that entails home checks and interviews. Altogether, second parent adoptions can cost up to $5,000, said Gideon Alper, a Florida adoption attorney who regularly counsels same-sex couples.

Related: Businesses band together to support gay marriage

And since same-sex couples are hurt by the tax code in many other ways -- they can't file jointly and owe estate and gift tax that opposite-sex couples don't, for example -- it's an important credit to know about.

"Same-sex couples face a big disadvantage tax-wise through the rest of the system by not being married [at a federal level], so this is like a saving grace that lets them save a little money," said Alper.

Sharon McGowan, from Takoma Park, Md., went through a second parent adoption late last year, after her wife, Emily, gave birth to their daughter, Sadie.

While Sharon and Emily are married at a state level, the federal government doesn't recognize their union and many other states don't either. So to guarantee Sharon has full parental rights wherever she goes, the couple spent over $2,000 in legal fees and other costs to adopt Sadie.

"I never wanted to have the risk of someone refusing to let me see Sadie in hospital or make medical decisions for Sadie," said Sharon. "I wanted to make sure my relationship with Sadie was airtight."

Related: 'What legalizing gay marriage means for our money'

The couple made sure to complete the adoption before the end of the year so they could qualify for the credit -- which was originally scheduled to expire on Dec. 31, but ended up being permanently extended under the fiscal cliff deal. They're hoping the tax credit this year will cover the adoption expenses they incurred.

The credit is nonrefundable, so it will offset some of their overall tax bill. And the extra money they don't have to put toward taxes this year will go toward Sadie's daycare.

The couple says they are lucky their state even allows second parent adoptions, since some don't. But they don't think the credit should be considered a "benefit," because they wouldn't have had to go through the second parent adoption process and incur those costs at all if their marriage had been federally recognized in the first place.

Along with second parent adoptions, the adoption credit is also available for joint adoptions where neither parent is the birth parent -- and both same-sex and opposite-sex couples can claim the credit in this case. Since same-sex couples can't file their taxes jointly, however, only one partner can claim the credit, or they must each claim a portion of it.

Related: Financial benefits at stake in gay marriage case

If DOMA is overturned, which is a possibility since the Supreme Court is expected to weigh in on the constitutionality of the law for the first time this year, same-sex couples who are married at the state level would also be considered married for federal tax purposes.

This means they would be able to file jointly, but they would no longer receive a credit for a second parent adoption.

It's up in the air whether couples in civil unions or domestic partnerships would still be allowed to take the credit, however. It will depend on whether the federal government's definition of marriage would encompass those relationships, said Patricia Cain, a law professor at Santa Clara University in California.

For Sharon and Emily, the inequities same-sex couples face under DOMA far outweigh the couple thousand dollars they will get that a married couple won't.

"We would be very, very happy to give up the adoption credit to have our marriage recognized," said Sharon. ![]()

First Published: February 25, 2013: 6:28 AM ET

U.K. vows to stick with austerity

Finance minister George Osborne says loss of AAA rating means cuts must continue

LONDON (CNNMoney)

Moody's cut its rating to Aa1 late Friday, saying growth would remain weak into the second half of the decade, making it harder for the government to deliver on its debt-cutting targets and undermining the ability of the U.K. to withstand future shocks.

"Britain has to stick to the course, and we will," finance minister George Osborne wrote in The Sun newspaper on Sunday.

"For we've had a stark reminder this weekend of the single most important truth about our economy -- Britain has a debt problem, built up over many years, and we have got to deal with it."

Moody's said it expected the U.K.'s debt to peak at 96% of gross domestic product in 2016, up from around 90% today.

A downgrade had been talked about for months, against the backdrop of a deepening recession in Europe and Osborne's acknowledgment late last year that borrowing would remain higher for longer than expected.

But it still served as a reminder of the poor growth prospects for the world's sixth biggest economy, and added fuel to speculation that the Bank of England will have to compensate for the lack of growth -- and the government's hawkish stance on fiscal policy -- by easing monetary policy still further.

Related: Eurozone economy to shrink again in 2013

Investors took the downgrade as another reason to sell sterling, extending a slide which began at the start of the year. The currency dropped 0.1% to its lowest level since July 2010 against the dollar, and 0.6% against the euro to levels last seen in October 2011.

Yields on 10-year government bonds have been rising for about six months and they ticked higher again Monday to 2.1%, still low by historical standards.

The Bank of England has signalled recently that it may be prepared to tolerate above-target inflation for longer, while growth remains weak. Three members of its monetary policy committee -- including outgoing Governor Mervyn King -- voted at its last meeting to expand its bond-buying program.

They were outvoted, but the previous time the committee split 6-3, the bank followed up at its next meeting with more monetary stimulus.

Related: Europe: No retreat from austerity

Osborne said Germany and Canada -- the only big economies still with AAA-ratings from all three major agencies -- had taken advantage of better times before the financial crisis to reduce deficits and make their economies more competitive, while Britain had built up the biggest structural deficit of all.

"Now we have no choice but to continue the hard work of putting our house in order," he wrote. ![]()

First Published: February 25, 2013: 7:23 AM ET

Barnes & Noble chairman wants to buy company - but not the Nook

NEW YORK (CNNMoney)

Riggio, who disclosed his plans in a filing with the Securities and Exchange Commission on Monday, did not name a price. Shares jumped 8% in early trading.

Riggio is already the largest shareholder of Barnes & Noble (BKS, Fortune 500), with nearly a 30% stake in the company.

The company had already been considering spinning off the Nook business as a separate company.

Last April, it announced a deal with Microsoft (MSFT, Fortune 500) in which Microsoft bought a 17.6% stake in Nook. Publisher Pearson (PSO) bought a 5% stake in Nook in December.

Those deals both value the overall Nook business at more than $1.7 billion, even though Barnes & Noble stock is worth just less than $800 million.

Related: Top 3 e-book picks

In early January, the company reported a weak Christmas season, with sales at its retail stores falling 11%. Sales at its Nook unit fell 12.6% to just $300 million.

Earlier this month, the company warned of rising losses and disappointing sales for its Nook unit in the past year, results of which are due Thursday.

Barnes and Noble and other traditional book retailers have struggled with competition from Amazon.com (AMZN, Fortune 500), which has its own Kindle e-book. Borders filed for bankruptcy two years ago and went out of business in July 2011.

![]()

First Published: February 25, 2013: 8:38 AM ET

Judge rules against Apple in Einhorn cash fight

Written By limadu on Minggu, 24 Februari 2013 | 22.16

NEW YORK (CNNMoney)

Einhorn's Greenlight Capital filed a lawsuit earlier this month seeking to "unbundle" a number of shareholder proposals that would have been voted on as a group, including one that would have made it difficult for the company to issue preferred stock. The vote on this, known as Proposal No. 2, was scheduled to be voted on at Apple's annual shareholder meeting on February 27.

Judge Richard Sullivan of the Southern District of New York ruled that bundling four different items in one proposal violates Securities and Exchange Commission regulations.

"Given the disparate, material nature of the items in Proposal No. 2, it is probable that Apple has improperly bundled four 'separate matters' for a single vote," the ruling states.

Apple (AAPL, Fortune 500)shares rose 1% on Friday. News of the ruling came just a few minutes before the market closed.

Einhorn has launched an activist campaign to get Apple to unlock some of its $137 billion in cash by issuing preferred stock, or iPrefs, as he calls them. He argues that allowing the cash to sit idle on Apple's balance sheet is bad for the company and its shareholders.

A spokesman for Greenlight said that the ruling "is a significant win for all Apple shareholders and for good corporate governance" and added that "we look forward to Apple's evaluation of our iPref idea and we encourage fellow shareholders to urge Apple to unlock the significant value residing on its balance sheet."

Related: Einhorn takes aim at Apple's cash hoard

But another big Apple shareholder was not pleased with the judge's ruling.

California's powerful pension fund, CalPERS, supported Apple's proposal, which it said would give shareholders more voting power over the issuance of Apple stock.

"We encourage Apple to reintroduce these measures as soon as is practical so that all investors can be heard," said Anne Simpson, a CalPERS senior portfolio manager and director of global governance. "We applaud the company's commitment to strengthening shareholder rights."

Apple has said it is reviewing Einhorn's proposal, but CEO Tim Cook has called the lawsuit a "silly sideshow."

Spokespeople for Apple could not immediately be reached for comment. ![]()

First Published: February 22, 2013: 5:01 PM ET

Moody's downgrades United Kingdom from AAA

God save the AAA rating.

NEW YORK (CNNMoney)

The U.K. was knocked down one notch to Aa1, with its ratings outlook at stable. Moody's said the key drivers of the downgrade included the country's rising debt burden and tepid growth outlook over the next few years.

"[A]lthough the U.K.'s debt-servicing capacity remains very strong and very capable of withstanding further adverse economic and financial shocks, it does not at present possess the extraordinary resilience common to other AAA-rated issuers," Moody's said.

The U.K. had held AAA status since Moody's first began rating the country in 1978.

In December, the U.K.'s budget monitor projected that the country's economy would grow by just 1.3% this year. The government has been pushing a much-criticized austerity program, and finance minister George Osbourne said he remained committed to those efforts, even after the downgrade.

"This is a stark reminder of the debt problems that Britain faces and the clearest possible warning to anyone who thinks we can run away from dealing with those problems," he said. "Far from weakening our resolve to deal with our debts, this should redouble our resolve."

Related: U.K. risks new recession

The British government has said its belt-tightening will have to continue until 2018.

In announcing the downgrade, Moody's said it expects the U.K.'s debt to peak at 96% of GDP in 2016, up from around 90% today.

A year ago, Moody's switched the outlook on the U.K.'s AAA rating to negative, in a prelude to Friday's downgrade. At the same time, the firm cut the ratings of half a dozen European countries.

The other major rating agencies, Fitch and Standard & Poor's, still have the U.K. rated AAA, though with negative outlooks.

Elsewhere in Europe, France lost its AAA rating from Moody's in November, after a similar downgrade from S&P in January.

The United States maintains its AAA rating from Moody's and Fitch, though it was downgraded by S&P in August 2011 following the debt ceiling standoff in Washington.

Steven Englander, a foreign exchange strategist with Citigroup (C, Fortune 500), said in a research note following the downgrade that the move was unlikely to raise borrowing costs for the U.K., as bond yields in the United States, France and Japan had remained stable following similar downgrades. But it increases pressure on the country to pursue growth by weakening the pound, he added.

"[W]hile by itself the announcement merely accelerates what was expected to happen at some point, the need for weakness [in the British pound] will become more apparent to policymakers and investors," Englander said.

Among Europe's other major economies, Germany, Switzerland and the Netherlands maintain their AAA ratings from Moody's. France sits at Aa1, while Italy is down at Baa2 with Spain at Baa3. ![]()

First Published: February 22, 2013: 5:01 PM ET

Samsung stuffs a phone in new Galaxy Note 8.0 tablet

NEW YORK (CNNMoney)

It runs Android 4.1, has a 1.6 GHz quad-core CPU, 2 gigabytes of RAM, and an 8-inch, 1280 x 800 display that you can control with Samsung's S-Pen stylus. But on the international version of the device, there's something quite strange lurking near the top.

Yes, it's an earpiece. Yes, it's meant for you to make calls. Yes, Samsung expects you to hold an 8-inch tablet up to your face.

Samsung expects you to hold an 8-inch tablet up to your face.

The decision to imbue an 8-inch tablet with a phone very much seems like a reaction to the success of Samsung's Galaxy Note phones, which checked in at 5.3 and 5.5-inches, opening up some of the functionality of tablets. (Ugh, phablets).

I joked before about the day when we'd see a 7-inch phone. Turns out we got an 8-inch one sooner than we thought. But it is worth mentioning that it's undecided if a phone-enabled version of the Galaxy Note 8.0 will see the light of day in the U.S.

The device itself is suitably thin and light (more or less comparable to the iPad mini, it's closest known competition), and is responsive enough for most tasks. The stylus works pretty well, introducing a new feature that lets you activate preview panes of apps such as email and Flipboard, without ever touching the the screen (instead, you hover above the area you want to preview).

Related: Samsung overtakes Apple in 'smart connected devices'

But aside from the stylus, it also has a couple of tricks the iPad Mini does not. For starters, It has an IR remote which lets you enter the codes for most television sets and control your TV with your tablet, much like you would with any other remote. But sweetening the deal is the use of the media guide software from Peel Technologies, allowing you to seek out and directly jump to specific shows and movies without resorting to the channel up/down buttons.

It also supports a dual-window mode, where you can run two apps side by side, and without the loss of functionality. For now it only works with a handful of optimized apps, but includes a calendar app, a note-taking app, Chrome, Gmail, YouTube and more (adding up to more than 20 in all).

And while it's expected to arrive sometime in the next few months, there was not so much as a whisper about price. Judging from the year-old guts inside the Galaxy Note 8.0, it's possible Samsung made the necessary moves to offer it at a mainstream price point. If it falls anywhere under the $330 price tag of Apple's iPad Mini, it might just have what it takes to steal some of Cupertino's thunder.

But why...why does it have to have a built-in phone? ![]()

First Published: February 23, 2013: 9:57 PM ET

Fed officials: Don't worry if we lose money

Written By limadu on Sabtu, 23 Februari 2013 | 22.16

NEW YORK (CNNMoney)

But that's okay, Fed officials say.

After years of record profits, the Fed is likely to be saddled with losses starting in 2017 or 2018, economists predict in a paper that was presented Friday at the U.S. Monetary Policy Forum, a New York conference organized by the University of Chicago Booth School of Business.

Here's the scenario they think will play out: As the economy improves, the Fed will eventually tighten monetary policy. The central bank will stop buying mortgage-backed securities and Treasuries by the end of this year, they believe, and start raising interest rates in 2015.

Eventually, the Fed will have to start selling off the massive collection of bonds it acquired in its stimulus efforts.

And when that time comes, even the Fed admits that it will probably incur losses.

Inside the Fed's finances

Unlike most government agencies, the Federal Reserve funds itself. Its expenses are not paid for in by U.S. federal budget.

Each year after paying its own bills, the central bank hands over all its remaining profit to the Treasury Department. Most of the money comes from interest earned on holdings like Treasury bonds and other debt.

Those payments have ballooned in recent years. The Fed is earning huge profits from the large bond portfolio it amassed (and continues to amass) during its stimulus efforts.

In the decade preceding the Great Recession, the Fed paid out an average of $25 billion a year to the Treasury. In the last three years, its remittances have averaged $81 billion.

Based on those numbers, you could call the Fed the most profitable bank in the world. It's generating more income than America's top five banks -- JPMorgan Chase (JPM, Fortune 500), Wells Fargo (WFC, Fortune 500), Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500) and Goldman Sachs (GS, Fortune 500) -- combined.

Once the economy improves to its liking -- which could still be years away -- the Fed will have to start shrinking its portfolio, to ward off rapid inflation.

As the economy gets better, the Fed will raise interest rates. At the same time, bond prices will probably fall as the Fed sells off massive amounts of them.

That means the central bank is likely to lose money.

That's not necessarily a problem. A relatively new accounting rule would allow the Fed to pay for its operations and make interest payments basically on credit, deferring its losses and paying them off later in profitable years.

The situation could easily become a public relations nightmare, though -- especially in the current political environment.

"We're in a period where the attacks on the Federal Reserve system are the worst I've seen in 40 years," said Frederic Mishkin, a former Fed governor who is now a professor at Columbia University.

"In any year where the Fed is not giving remittances back to the Treasury, this is going to come up big time in Congress," he added.

St. Louis Fed President James Bullard also calls it a "recipe for political problems." During the same period that the Fed will incur losses, the government will be paying billions of dollars in interest to foreign governments.

The Fed seems to be trying to get ahead of the PR blow-up.

The central bank put out a research paper on the topic last month, and minutes released earlier this week show the issue was discussed at the Fed's January meeting.

Since then, several officials have spoken about it quite openly.

"There is a chance that we could go through a period of time in which our income falls, and we could even take losses," said Janet Yellen, vice-chair of the Federal Reserve Board, in a speech last week.

Her colleague Jerome Powell, a Fed governor, reiterated that point Friday.

Some Fed watchers expect Fed Chairman Ben Bernanke to discuss the topic when he speaks before Congress next week in his semi-annual testimony.

He's stuck in a "damned if you do, damned if you don't" position. If the economy improves, great -- but when it does, the Fed has big losses and a PR crisis to look forward to. ![]()

First Published: February 22, 2013: 2:27 PM ET

Judge rules against Apple in Einhorn cash fight

NEW YORK (CNNMoney)

Einhorn's Greenlight Capital filed a lawsuit earlier this month seeking to "unbundle" a number of shareholder proposals that would have been voted on as a group, including one that would have made it difficult for the company to issue preferred stock. The vote on this, known as Proposal No. 2, was scheduled to be voted on at Apple's annual shareholder meeting on February 27.

Judge Richard Sullivan of the Southern District of New York ruled that bundling four different items in one proposal violates Securities and Exchange Commission regulations.

"Given the disparate, material nature of the items in Proposal No. 2, it is probable that Apple has improperly bundled four 'separate matters' for a single vote," the ruling states.

Apple (AAPL, Fortune 500)shares rose 1% on Friday. News of the ruling came just a few minutes before the market closed.

Einhorn has launched an activist campaign to get Apple to unlock some of its $137 billion in cash by issuing preferred stock, or iPrefs, as he calls them. He argues that allowing the cash to sit idle on Apple's balance sheet is bad for the company and its shareholders.

A spokesman for Greenlight said that the ruling "is a significant win for all Apple shareholders and for good corporate governance" and added that "we look forward to Apple's evaluation of our iPref idea and we encourage fellow shareholders to urge Apple to unlock the significant value residing on its balance sheet."

Related: Einhorn takes aim at Apple's cash hoard

But another big Apple shareholder was not pleased with the judge's ruling.

California's powerful pension fund, CalPERS, supported Apple's proposal, which it said would give shareholders more voting power over the issuance of Apple stock.

"We encourage Apple to reintroduce these measures as soon as is practical so that all investors can be heard," said Anne Simpson, a CalPERS senior portfolio manager and director of global governance. "We applaud the company's commitment to strengthening shareholder rights."

Apple has said it is reviewing Einhorn's proposal, but CEO Tim Cook has called the lawsuit a "silly sideshow."

Spokespeople for Apple could not immediately be reached for comment. ![]()

First Published: February 22, 2013: 5:01 PM ET

Moody's downgrades United Kingdom from AAA

God save the AAA rating.

NEW YORK (CNNMoney)

The U.K. was knocked down one notch to Aa1, with its ratings outlook at stable. Moody's said the key drivers of the downgrade included the country's rising debt burden and tepid growth outlook over the next few years.

"[A]lthough the U.K.'s debt-servicing capacity remains very strong and very capable of withstanding further adverse economic and financial shocks, it does not at present possess the extraordinary resilience common to other AAA-rated issuers," Moody's said.

The U.K. had held AAA status since Moody's first began rating the country in 1978.

In December, the U.K.'s budget monitor projected that the country's economy would grow by just 1.3% this year. The government has been pushing a much-criticized austerity program, and finance minister George Osbourne said he remained committed to those efforts, even after the downgrade.

"This is a stark reminder of the debt problems that Britain faces and the clearest possible warning to anyone who thinks we can run away from dealing with those problems," he said. "Far from weakening our resolve to deal with our debts, this should redouble our resolve."

Related: U.K. risks new recession

The British government has said its belt-tightening will have to continue until 2018.

In announcing the downgrade, Moody's said it expects the U.K.'s debt to peak at 96% of GDP in 2016, up from around 90% today.

A year ago, Moody's switched the outlook on the U.K.'s AAA rating to negative, in a prelude to Friday's downgrade. At the same time, the firm cut the ratings of half a dozen European countries.

The other major rating agencies, Fitch and Standard & Poor's, still have the U.K. rated AAA, though with negative outlooks.

Elsewhere in Europe, France lost its AAA rating from Moody's in November, after a similar downgrade from S&P in January.

The United States maintains its AAA rating from Moody's and Fitch, though it was downgraded by S&P in August 2011 following the debt ceiling standoff in Washington.

Steven Englander, a foreign exchange strategist with Citigroup (C, Fortune 500), said in a research note following the downgrade that the move was unlikely to raise borrowing costs for the U.K., as bond yields in the United States, France and Japan had remained stable following similar downgrades. But it increases pressure on the country to pursue growth by weakening the pound, he added.

"[W]hile by itself the announcement merely accelerates what was expected to happen at some point, the need for weakness [in the British pound] will become more apparent to policymakers and investors," Englander said.

Among Europe's other major economies, Germany, Switzerland and the Netherlands maintain their AAA ratings from Moody's. France sits at Aa1, while Italy is down at Baa2 with Spain at Baa3. ![]()

First Published: February 22, 2013: 5:01 PM ET

Citigroup CEO Corbat's pay: $11.5 million

Written By limadu on Jumat, 22 Februari 2013 | 22.16

Citigroup CEO Michael Corbat took home an $11.5 million pay package last year.

NEW YORK (CNNMoney)

The pay package, disclosed in a regulatory filing late Thursday, comes a year after Citigroup shareholders rejected a $15 million pay package for then-CEO Vikram Pandit.

Pandit resigned due to board pressure in October. He received $6.7 million for his time at the helm in 2012, according to an earlier Citigroup filing.

Michael O'Neill, Citigroup's chairman, said Corbat's salary structure "more strongly connects compensation with performance, emphasizes strong risk management, and is both competitive and in line with regulatory standards." When Citi's compensation committee sought to determine Corbat's pay, it consulted with major shareholders, who between them hold 30% of Citigroup shares.

The group decided to change the way Citi's top brass get paid: Instead of the traditional deferred cash compensation, 30% of their pay last year came in the form of "performance share" stock grants. Those shares won't be paid until 2015, and the amount of stock doled out will be based on how well the company performs. Total shareholder return compared to peers and return on assets will be determining factors.

Corbat is due to get up to $3.1 million in that segment of his pay package.

But Corbat's $4.2 million cash bonus was relatively unique to Wall Street last year. Cash bonuses were missing from the pay packages already announced for Jamie Dimon, CEO of JPMorgan Chase (JPM, Fortune 500), James Gorman, CEO of Morgan Stanley (MS, Fortune 500) and Brian Moynihan, CEO of Bank of America (BAC, Fortune 500). Among the major Wall Street bosses, only Goldman Sachs (GS, Fortune 500) CEO Lloyd Blankfein received a cash bonus -- $5.6 million, as part of his $21 million total pay package.

Related: Dimon says life goes on after 'Whale' loss

Dimon, who had his pay slashed by 53% following a huge trading loss at the JPMorgan last year, received his entire bonus in stock last year. In 2011, when he was the top paid bank CEO, he received a cash bonus of $4.5 million as part of his $23 million package.

By contrast, BofA's Moynihan received a large raise last year. Moynihan was paid $12 million in 2012, up from $7 million in 2011, but he did not receive a cash bonus either year.

Corbat's pay package comes in a year that Citigroup announced plans to cut 11,000 jobs worldwide. The downsizing was his first major initiative as CEO.

Corbat had headed Citigroup's operations in Europe, the Middle East and Africa prior to his promotion to CEO in October. Shares of Citigroup, which have risen 15.5% since his appointment, were up nearly 1% in premarket trading. ![]()

First Published: February 22, 2013: 8:13 AM ET

Millions more could join Medicaid as Republican governors cave in

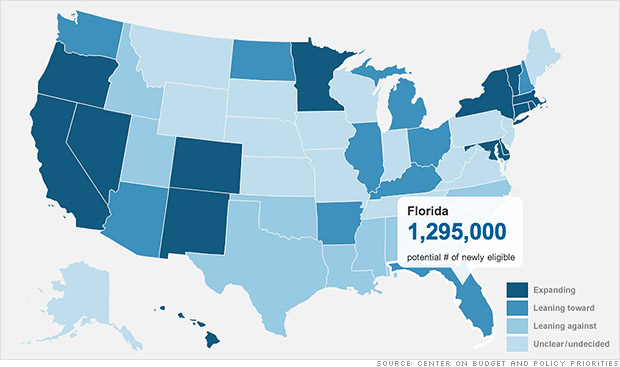

Click on the map to see how many adults could become eligible for Medicaid if each state chose to expand.

NEW YORK (CNNMoney)

Florida Governor Rick Scott on Wednesday became the latest to warm up to the expansion, which broadens coverage to adults with incomes below 138% of the poverty line. Medicaid rules vary from state to state, but many states (including Florida) do not currently cover most childless, non-disabled and non-elderly adults.

Scott, a former health care executive, follows his GOP peers in Ohio, Michigan, Arizona, New Mexico, Nevada and North Dakota in accepting a reform they once strongly opposed.

The Supreme Court ruled last year that states can opt out of broadening Medicaid coverage, striking down one of the provisions of the Affordable Care Act. Some 15 states have chosen to participate so far, with another 10 leaning towards expansion, according to the Center on Budget and Policy Priorities, a liberal group.

Though many Republican governors say their state can't afford the cost of expansion, the political resolve of some has crumbled over the past two months in the face of heavy pressure from hospital associations, medical groups, local governments and others. Providers -- particularly hospitals, where many uninsured folks go for care -- say their costs of treating those without coverage would fall under the expansion.

"Medicaid expansion is a very good deal that's hard to pass up," said January Angeles, a senior policy analyst at the center. "In a lot of these states, a lot of stakeholders have done a good job making the business case."

Most states will have to shell out very little at first -- in the early years. The federal government will pick up 100% of the cost for the first three years, and then gradually reduce its subsidy to 90% by 2020.

Over the next decade, expanding Medicaid is expected to cost states only another $8 billion, or 0.3% more, that they would have otherwise spent, according to an Urban Institute estimate. Some 14.3 million citizens would be newly eligible if every state enrolled.

Various interest groups have put a full-court press on governors and lawmakers, said Ed Haislmaier, a senior research fellow at the conservative Heritage Foundation, which opposes broadening Medicaid.

"They want to get their hands on that money," he said.

The financial argument helped sway Scott, who still has to convince a Republican-led legislature to sign on. Some 1.3 million adult Floridians would become eligible for Medicaid under the expansion.

"While the federal government is committed to paying 100% of the cost of new people in Medicaid, I cannot, in good conscience, deny the uninsured access to care," he said Wednesday when announcing his decision to participate for three years.

Now that Scott is on board, Texas remains the last big holdout.

Texas has the highest share of uninsured in the nation, at nearly a quarter of residents. Some 1.75 million adults would be newly eligible if the Lone Star State joins in. It stands to gain $25.3 billion in federal funds over four years to insure poor adults, while spending $1.3 billion, according to the Center for Public Policy Priorities, an advocacy group for low-income Texans.

Related: Who covers health care for Texas' uninsured? Taxpayers

On Thursday morning, representatives from counties, hospitals, insurers and other groups discussed coordinating their message to Governor Rick Perry and lawmakers in Austin.

"We are making the case that people are already paying for that care in a fragmented and inefficient manner," said John Hawkins, senior vice president of government relations for the Texas Hospital Association. "We have to tell the story of how the expansion is financed."

Hospitals, for instance, already provide $5 billion a year in uncompensated care. That shortfall gets made up by raising premiums for private patients and levying property or sales taxes on residents in special "hospital districts."

"It's a hidden tax," Hawkins said. Federal funds could cover a significant portion of that.

So far, though, Perry is not convinced.

"The governor's position has not changed," said his spokeswoman, Lucy Nashed. "It would be irresponsible to add more Texans and dump more taxpayer dollars into an unsustainable system that is broken and already consumes a quarter of our budget." ![]()

First Published: February 22, 2013: 9:30 AM ET

Stocks bounce back after two-day slide

Click chart for more market data.

NEW YORK (CNNMoney)

Friday's gains follow two days of sell-offs that marked the biggest two-day drop in U.S. stocks this year.

The Dow Jones Industrial Average, the S&P 500 and the Nasdaq moved up between 0.4% and 0.6%.

All three indexes are on track for their worst week of 2013. A pullback is not unusual though, given how well the market has done so far this year. Investors rushed back into stocks at the beginning of the year, and continue to add money to the U.S. stock market, but at a much more tempered pace.

CNNMoney's Fear & Greed Index has also eased into greed (it had been stuck in extreme greed since the start of the year). And the market's other fear gauge, the VIX (VIX), has jumped more than 17% over the past five days, although it still has a ways to go before it crosses deep into fear mode.

Related: Investors' rush into stocks slows

Despite the recent losses, the Dow is still up nearly 6% since the beginning of the year, the S&P 500 (DIVD)has gained 5% and the Nasdaq Composite (COMP) is up almost 4%.

After the closing bell Thursday, Hewlett Packard reported its first-quarter profit fell 11% from a year ago, and sales declined 6%. But expectations for HP are so low that the figures came in above analysts' estimates, sending shares of HP (HPQ, Fortune 500) up 8%.

AIG (AIG, Fortune 500) also reported better-than-expected earnings after the bell on Thursday, pushing the stock up nearly 5%.

European markets staged a partial recovery from Thursday's sell-off in morning trading, although the mood remained cautious ahead of new official European growth forecasts due later Friday, and a key election in Italy this weekend.

Asian markets ended mixed. Japan's Nikkei added 0.7%, while the Shanghai Composite and Hang Seng lost 0.5%.

Related: Check gas prices in your state

Gas prices have risen for 36 straight days. Nationwide, a gallon of unleaded gasoline cost an average of $3.78 Friday, according to AAA. That's up 49 cents, or 15% since January 17, when prices started rising.

Oil prices edged higher while gold prices declined.

The dollar lost ground versus the British pound but gained against the euro and the Japanese yen.

The price on the 10-year Treasury increased slightly, pushing the yield down to 1.97% from 1.98% Thursday. ![]()

First Published: February 22, 2013: 9:42 AM ET

Jobless claims rise

Written By limadu on Kamis, 21 Februari 2013 | 22.16

Job seekers at a recent New York City jobs fair.

NEW YORK (CNNMoney)

The Labor Department report showed 362,000 Americans filed for jobless benefits in the latest week, up from 342,00 the previous week, when claims may have been limited by snow storms in several states.

The average number of people seeking help over the past four weeks totaled 360,750, up 8,000 from the four-week average the previous week. Economists prefer to look at the four-week average to smooth out the impact of short-term blips that can be caused by weather and other special events.

Related: Unemployed would lose benefits if federal budget cuts go through

Overall, average claims are down from where they were a year ago, but the improvement has been very gradual. They've largely been hovering in the 350,000 to 400,000 range -- a level that seems to be consistent with the U.S. economy, which has added about 180,000 jobs each month. But that's barely enough to keep up with population growth and not enough to make significant improvement in reducing the unemployment rate.

In addition to counting first-time claims, the Labor Department also tracks people who have filed for their second week or more of benefits. The latest data show 3.1 million people filed continuing claims during the week ended February 9, an 11,000 increase from a week earlier, but down nearly 8% from those receiving longer-term help a year ago. ![]()

First Published: February 21, 2013: 8:49 AM ET

Stocks open in the red

Click the chart for more premarket data.

NEW YORK (CNNMoney)

The Dow Jones industrial average declined 0.3%, while the S&P 500 and Nasdaq fell 0.4%.

Investors were disappointed after survey of purchasing managers showed Europe's downturn worsened in February. The index has been stuck below 50 for a year, indicating the services sector has been contracting. European markets fell sharply following the data.

In United States, initial jobless claims rose to 362,000 last week, coming in higher than economists were expecting.

The Consumer Price Index was unchanged month-over-month in January, and up 1.6% from a year ago. Core CPI, which strips the price of food and energy, increased 0.3% month-over-month in January, and 1.9% from a year earlier.

At 10 a.m. ET, the National Association of Realtors will release data on existing home sales, while the Philadelphia branch of the Federal Reserve will release its monthly business outlook survey.

On the corporate front, Wal-Mart (WMT, Fortune 500) reported earnings that beat forecasts but said sales had softened during the quarter. The retailer also hiked its annual dividend by 18%.

Related: Crunched consumers are cutting back

Tesla (TSLA) shares sank 9% after the electric-car maker posted a wider-than-expected loss for the fourth quarter.

Hewlett-Packard (HPQ, Fortune 500) is up after the closing bell.

Shares of Constellation Brands (STZ) jumped after Anheuser-Busch InBev (BUD)and Grupo Modelo SAB said they are in talks with the Justice Department to try and resolve an antitrust lawsuit challenging their planned merger. Last week, AB InBev agreed to sell Constellation its rights to distribute Modelo in the United States as well its brewery in Piedras Negras, Mexico, in an effort to rescue the deal.

Apple (AAPL, Fortune 500) shares fell 0.7% after Foxconn (FXCNF) said it is slowing its hiring of workers at factories in China. The Taiwanese company makes about 40% of the world's consumer electronics gadgets, including products and parts for Apple, Intel (INTC, Fortune 500)and Cisco (CSCO, Fortune 500).

U.S. stocks ended lower Wednesday after Federal Reserve meeting minutes raised worries the central bank might scale back its bond-buying program. Despite Wednesday's losses, stocks are still up between 5% and 6% so far this year.

Fear & Greed Index still showing extreme greed

Asian markets ended weaker, also following the U.S. lead. The Shanghai Composite lost 3.0%, the Nikkei fell 1.4% and the Hang Seng declined 1.7%.

The dollar rose against the euro but was weaker versus the pound and the Japanese yen.

Oil and gold prices declined.

The price on the 10-year Treasury rose, pushing the yield down to 1.98% from 2.02% late Wednesday. ![]()

First Published: February 21, 2013: 9:49 AM ET

Biggest problems with the budget cuts

The March 1 budget cuts will affect Americans in myriad ways, like at airport check-in lines.

NEW YORK (CNNMoney)

The cuts are bad policy.

They're indiscriminate: They give spending cuts a bad name. The law governing them requires that they be applied in a uniform way across the board.

In other words, the meat of the federal government will be cut along with the fat, and by the same percentages in many instances. So needed projects and investments will be cut in equal measure with bloated projects that are duplicative. And people doing good work will lose jobs or pay right alongside people who do shoddy work.

"There's no business in the country that makes its cuts across the board. You ... try to surgically cut those things that have the least adverse effect on productivity," Erskine Bowles, who co-chaired President Obama's fiscal commission, said at a Politico breakfast this week.

(Related: Jobless benefits would be hit)

They cut from the smallest part of the budget: Most of the cuts will come from discretionary spending -- defense and nondefense -- which together account for just over a third of all spending.

What's more, discretionary spending has already been subject to spending curbs. So much so that even without the March 1 cuts, discretionary spending is on track to fall to a 50-year low as a share of the economy by the end of the decade.

That doesn't mean more can't be cut from discretionary, but the magnitude, the manner and the timing of the March 1 cuts are ill-advised.

They don't really address the debt: The irony is that while the spending cuts will reduce deficits, they won't do anything to keep the country's debt from growing at an unsustainable rate.

That's because the real drivers of the country's debt -- in particular the entitlement programs Medicare and Social Security -- are largely exempt from the March 1 cuts.

The big entitlements take up the largest single part of the budget now -- about 43% of all spending -- and will swallow up ever larger chunks over the next few decades because of the aging of the population and the still-fast-growing cost of health care.

Indeed, spending on entitlements and interest on the debt, barring any changes, will grow faster than the economy indefinitely.

"They keep slashing the one-third of the budget that has already been seriously squeezed by the [2011 Budget Control Act's] spending caps, while not taking any significant actions on entitlement spending or tax expenditures," said budget expert Charles Konigsberg.

So given all the strikes against it, why is the so-called sequester still in place? Because lawmakers can't get it together to replace it with something better.

They might get around to it by the end of March -- or March 27 to be precise. That's when the current government funding bill, known as a continuing resolution, expires. If Congress doesn't pass a new one, the government will shut down on March 28.

That's a rather unattractive prospect for both parties.