Click chart for more markets data.

NEW YORK (CNNMoney)

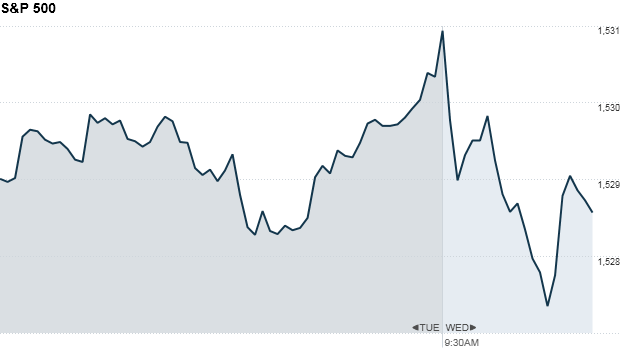

Investors weren't willing to push stocks higher Wednesday morning, one day after the Dow and S&P closed at new 5-year highs.

The Dow Jones Industrial Average, the S&P 500, and the Nasdaq dipped slightly in morning trading.

Investors shrugged off another round of positive data on the housing market.

Building permits, an indication of future residential construction, rose more than expected in January to a seasonally adjusted annual rate of 925,000. That's up 1.8% from December and marks the best month since June 2008.

Meanwhile, new construction slowed. Housing starts were at a seasonally adjusted annual rate of 890,000 in January. That's 8.5% below the revised December rate.

Homebuilder Toll Brothers (TOL) reported revenue and earnings that fell short of analysts' expectations. Toll Brothers shares fell 3%.

But the housing recovery is still a bright spot in the economy. "After seven years of trepidation, buyers are reentering the housing market and household formations are increasing," said Robert Toll, Toll Brothers executive chairman, in a statement.

Investors have been pulling back a bit after a strong start to the year. All three indexes are up between 6% and 8%, with the Dow just 1.2% shy of its all-time high from October 2007. The S&P 500 is less than 3% below its record high, also set in October 2007.

Related: Bonds are riskier than stocks

A separate report on the Producer Price Index showed wholesale prices rose 0.2% in January, slightly less than economists had expected.

At 2 p.m. ET, the Federal Reserve will release the minutes of its policy meeting from January 29-30, which investors will parse for clues about how long the central bank will continue its stimulus efforts.

U.S. stocks rose Tuesday, with the Dow and S&P 500 finishing at new 5-year highs and not far off records set in October 2007.

Related: Fear & Greed Index still in 'extreme greed'

On the corporate front, Office Depot (ODP, Fortune 500) announced that it would merge with OfficeMax (OMX, Fortune 500). Shares of OfficeMax shares rose about 10%, while Office Depot's stock dipped.

Mining firm BHP Billiton (BBL) said lower commodity prices and a weaker U.S. dollar in the second half of 2012 more than offset its stronger volumes. The company also announced that CEO Marius Kloppers will retire in May, and will be succeeded by Andrew Mackenzie, who previously headed the company's division specializing in non-ferrous metals. BHP shares fell 2.8%.

Rio Tinto (RIO)shares fell, amid tensions surrounding its copper mine in Mongolia. The Mongolian government owns 34% of the mine and is demanding a greater share of profit.

SodaStream (SODA) shares dropped, even though the Israel-based company announced stronger than expected earnings and revenue in its fourth quarter. The company expects its 2013 revenue to grow 25% over last year, an estimate that was slightly more conservative than analysts' had hoped.

Tesla (TSLA) is scheduled to report results after the closing bell.

After the close Tuesday, Dell (DELL, Fortune 500) reported earnings and revenue that fell from a year ago but topped analyst expectations. Its shares rose Wednesday morning.

Controversial nutritional supplements company Herbalife (HLF) also announced better-than-expected earnings and sales figures Tuesday afternoon. Management will hold a conference call later Wednesday morning to discuss the results.

European markets were mixed in afternoon trading, while Asian markets ended higher. The Shanghai Composite advanced 0.6%, the Hang Seng added 0.7% and Japan's Nikkei gained 0.8%.

Related: Check gas prices in your state

Gas prices rose for the 34th day in a row, fueling concerns about whether higher prices at the pump will take a bite out of consumer spending in February. Nationwide, a gallon of unleaded gasoline averaged $3.766 Wednesday, according to AAA. Gas prices have risen 34 cents, or 10%, since the beginning of February.

Oil prices rose, while gold prices declined, falling below $1,600 an ounce for the first time since August 2012.

The price on the 10-year Treasury stayed steady with its yield at 2.03%.

The U.S. dollar fell against the euro but gained against the British pound and the Japanese yen. ![]()

First Published: February 20, 2013: 9:50 AM ET

Anda sedang membaca artikel tentang

Stocks dip but still near record highs

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/02/stocks-dip-but-still-near-record-highs.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks dip but still near record highs

namun jangan lupa untuk meletakkan link

Stocks dip but still near record highs

sebagai sumbernya

0 komentar:

Posting Komentar