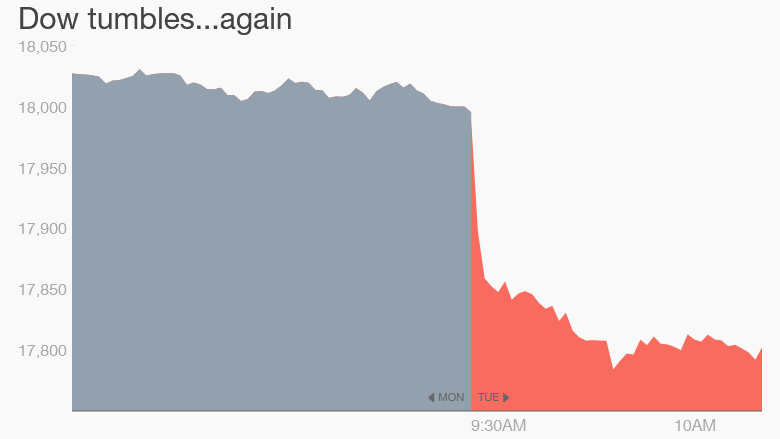

The Dow plummeted as much as 240 points within the first hour of trading. The S&P 500 and Nasdaq both dropped over 1% Tuesday morning.

The momentum sure isn't going in the direction investors prefer. Although the S&P 500 is still only about 3% from its all-time high last week, Tuesday marks the second big slide in three days.

What's causing all this commotion in the markets? Blame China, the strong dollar and Basel's latest banking rule idea.

The U.S. dollar is now trading at a 12-year high against the euro. That's great for any Americans booking trips to Europe, but it's not so great for big multinational companies trying to sell their goods abroad -- or bring their foreign profits back to the U.S. The high dollar makes it harder for American companies to compete against their European counterparts, who can offer products at a lower cost.

Bank trouble: On top of that, bank stocks are tumbling. Citigroup (C), MetLife (MET) and Prudential Financial (PFK) were among the fastest falling stocks Tuesday morning. Banks are going through rounds of stress tests with the Fed this week, and a report from a Japanese media outlet indicated that Basel is thinking about implementing a rule to require major international banks to hold even more capital on hand.

Citigroup failed one stress test last year, and there's uncertainty about how many banks will pass this year. Bank stocks are down the most of any stock sector Tuesday. All categories, except the very defensive utility companies, are down.

Related: Cheap oil is a major investing opportunity

Then there's China. It's breakneck growth is slowing, and the latest economic news from China only added to the belief that the decelerating is ongoing. China's inflation index went up while the producer's price index showed manufacturers are struggling to make profits.

Volatility is back: Tuesday is starting to look much like the end of last week.

Markets took a nosedive Friday after a strong U.S. jobs report stirred rumors that the Federal Reserve would raise its key interest rate perhaps by June -- a concerning event for stock investors. Low interest rates are helping to drive the 6-year old bull market. Any bump up in interest rates could end the run.

Related: The bull market just turned 6 years old. Now what?

Many experts believe stocks are too expensive and the markets are due for a correction (that's when the market falls by 10% or more). That hasn't happened since 2011. One popular measure, the Shiller P/E, shows stock values are at levels last seen right before the 2008 financial crisis. That's high, although not as high as the run up to the Dotcom Bubble.

CNNMoney (New York) March 10, 2015: 11:05 AM ET

Anda sedang membaca artikel tentang

Ugly day: Dow tumbles over 200 points

Dengan url

http://kasiatbuatsehat.blogspot.com/2015/03/ugly-day-dow-tumbles-over-200-points.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Ugly day: Dow tumbles over 200 points

namun jangan lupa untuk meletakkan link

Ugly day: Dow tumbles over 200 points

sebagai sumbernya

0 komentar:

Posting Komentar