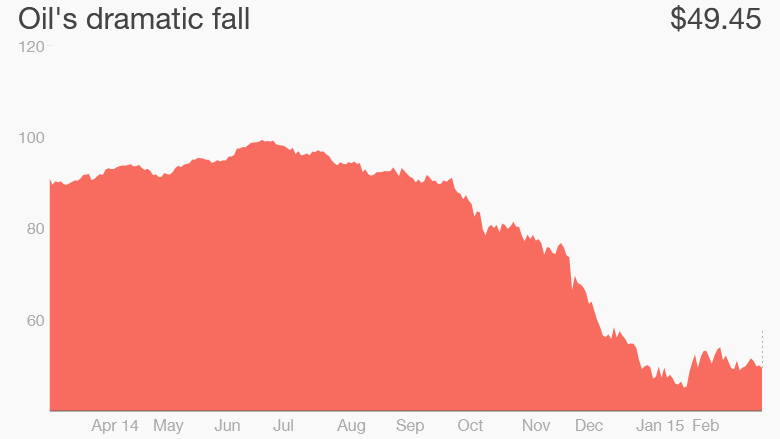

Too many people see this recent blip in prices and assume "this time is different" and oil prices won't do the exact same thing they have always done for the past 150 years.

I get it, things do look different at the moment, and it can be tempting to make investing decisions based on our perception of our surroundings. By doing so, though, you might overlook critical factors that could make energy an immense investing opportunity just staring you in the face.

Related: This should be your first investment

Living in our own world: I live in the Washington, D.C. metro area, and by recent count I have seen more Teslas and other all-electric vehicles driving the roads than I have seen supersized SUVs that chug gasoline faster than your college buddy "The Tank" could down a beer. Solar panels are becoming prominent fixtures on homes to the point that you are almost as likely to see one on a roof than not. Overall, there is just a general feeling that people are much more conscious of energy choices.

Nationwide statistics even seem to support the eye test. Since 2005, total crude oil consumption in the U.S. has declined by 10%, and improving fuel efficiency with alternative energy vehicles could take an even bigger bite out of that. Total megawatts, or solar panels installed, has increased by more than 10 times in the past four years alone, and shows no signs of stopping soon.

Related: The Average American Retires at This Age. Will You?

If I were to make investment decisions based on my assessment of the surrounding environment, it wouldn't seem too insane to drop all of my oil and gas stocks and invest exclusively in alternatives. But that assessment would ignore one thing: the world is much bigger and way more diverse than my little corner of the world. Currently, the U.S. represents about 4.5% of the global population, and the country's median income -- about $50,000 -- puts the typical American well within the top 1% of wage earners in the world.

The bigger picture: These kinds of statistics can be applied to energy as well. Per-capita domestic consumption of oil is 900 gallons per year, more than 4.5 times the global average and close to 10 times the annual average consumption of the 5.8 billion people living in the developing world.

Related: ExxonMobil Corporation Has Been Preparing to Handle Cheap Oil for Years

This isn't to show that the American population is better off than a large part of the world, it's just a reminder that our decision making can be biased by our upbringing and environment, which just happens to be one of the most mature energy markets in the world. If we don't look beyond our own developed world, we'll miss that massive demographic of developing nations that are quickly growing in population, producing and consuming more goods, and looking to improve their overall quality of life.

Staggering global growth is anticipated over the next 25 years, which will have a massive impact on energy companies. Here are just a few examples:

- Global population is estimated to grow from 7 billion to 9 billion in the next 30 years.

- Gross world product -- GDP for the planet -- is expected to grow from $75 trillion today to close to $160 trillion by 2040. This means that transport of goods will increase immensely.

- The world's "middle class" -- those with purchasing power between roughly $15,000 and $36,500 annually -- is forecast to grow from 1.8 billion today to 4.8 billion by 2030.

Lay of the (much larger) land: Yes, oil consumption in the developed world is expected to decline as more fuel-efficient and alternative fuel vehicles hit the market, and that technology should curb some potential oil demand in the developing world as well. Even so, the most conservative estimates indicate the need to increase oil production by 10 million barrels per day by 2030 to meet the demand from these demographic changes mentioned above. Some estimates say it could require up to 25 million barrels per day of additional production.

Related: Is the United States Sitting on Trillions of Barrels of Oil?

Meeting these needs, along with replacing the decline of existing oil wells, will require immense amounts of investment on development of new supplies. The International Energy Agency estimates producers will spend close to $23 trillion to maintain and grow production and to build out the infrastructure to handle that additional capacity by 2030.

You read that right: $23 trillion. That is close to the combined GDP of the U.S. and China today.

And guess what? There is plenty of oil and gas in the ground to meet this demand -- heck, the United States alone is sitting on trillions of barrels of potential petroleum. The real challenge is that it is not yet technologically possible nor economically feasible to access all these sources.

Related: Is it safe to buy oil stocks yet?

We may be headed for a time when you and I drive super efficient or alternative energy vehicles, but it's going to take the rest of world a long time -- and a lot of oil -- to get to where we are.

What this "Investing Fool" believes: It's tempting to observe the world around us and make assumptions about the future, and sometimes it can be profitable. When it comes to investing in energy, though, investors must be cognizant of the fact that the world is much bigger than our surroundings. Otherwise, you might see today's oil prices along with slumping demand here at home and assume investing in this space is a waste of money. That couldn't be any further from the truth.

Tyler Crowe has no position in any stocks mentioned. He writes for The Motley Fool. You can follow him at Fool.com or on Twitter @TylerCroweFool.

Related: 3 things Starbucks wants investors to know

(New York) March 10, 2015: 10:10 AM ET

Anda sedang membaca artikel tentang

Don't let cheap oil prices blind you to this major investing opportunity

Dengan url

http://kasiatbuatsehat.blogspot.com/2015/03/dont-let-cheap-oil-prices-blind-you-to.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Don't let cheap oil prices blind you to this major investing opportunity

namun jangan lupa untuk meletakkan link

Don't let cheap oil prices blind you to this major investing opportunity

sebagai sumbernya

0 komentar:

Posting Komentar