NEW YORK (CNNMoney)

That's because more employers are offering consumer-directed health plans, which usually come with high deductibles. In 2015, 81% of large employers will offer at least one of these plans, up from 63% five years earlier.

Consumer-directed plans typically carry deductibles of $1,500 for individual coverage, more than three times higher than traditional policies, according to the National Business Group on Health.

And these plans will be the only choice for a growing number of workers. The share of larger employers offering only consumer-directed policies is jumping to 32% for 2015, up from 22% this year.

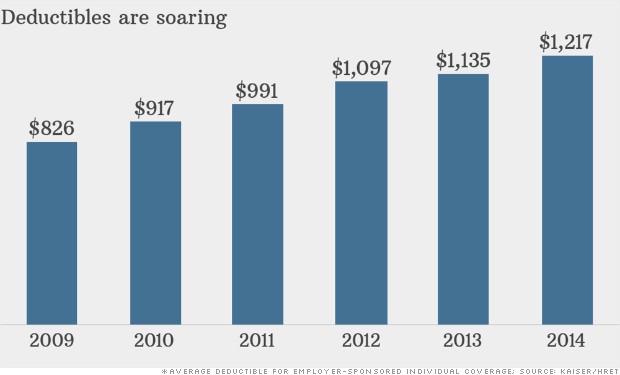

Deductibles are soaring for traditional insurance policies, too.

Deductibles for individual coverage at all firms have jumped to $1,217, on average, up 47% over the past five years, according to the 2014 Kaiser Family Foundation/Health Research & Educational Trust report. In high-deductible plans, they have hit $2,215.

Employers say they want more accountability, and higher deductibles force workers to take a larger role in their own care while shifting more of the costs to them.

Share your story: Are your health care deductibles going up?

Participants in these plans often have to pay more out of pocket -- not only for deductibles, but for doctors' visits, labs and procedures too.

On the plus side, they benefit from lower monthly premiums. Also, many employers contribute to savings accounts to help workers cover these costs. Annual checkups and preventative exams, such as colorectal screenings and mammograms, are free, as mandated by Obamacare.

Wells Fargo (WFC) switched to only consumer-directed plans in 2012. This year, the bank's employees can choose between two high-deductible policies -- one at $2,000 and the other at $3,000.

Doing so helped Wells Fargo keep plans affordable and allows it to offer a broad network of doctors and hospitals, said spokeswoman Richele Messick. "It gives them greater visibility into the cost of care and how they spend their health care dollars," she said.

Related: 5 ways you pay more for health insurance

Wells Fargo contributes up to $1,000 to workers' accounts, depending on their salary and the plan they choose. Employees can also earn up to $800 by participating in corporate wellness programs, including health screenings and quizzes.

For many, however, high-deductible health plans are a burden. They are nearly twice as likely to skip going to the doctor when sick or injured as those with traditional plans, according to a recent survey by the Associated Press-NORC Center for Public Affairs Research. Also, they are more likely to have difficulty paying other bills and to have decreased the amount they save.

Medical care has become more costly for the Vance family under a high-deductible plan.

Medical care has become more costly for the Vance family under a high-deductible plan. Melissa Vance has had to go back to work. Her husband's employer just jacked up the family's deductible from $0 to $5,000. The Columbia, S.C., couple has four children with chronic conditions that require frequent lab work and costly medications.

Last year, Vance estimated she paid $2,000 for the family's health care. This year, the tab will likely surpass $10,000, which she said will take them years to pay off.

"I have a stack of bills I haven't even opened," said Vance, who now works part-time as an administrative assistant. "I get nauseous every time I look at them."

First Published: October 27, 2014: 6:26 AM ET

Anda sedang membaca artikel tentang

Paying thousands before health insurance even kicks in

Dengan url

http://kasiatbuatsehat.blogspot.com/2014/10/paying-thousands-before-health.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Paying thousands before health insurance even kicks in

namun jangan lupa untuk meletakkan link

Paying thousands before health insurance even kicks in

sebagai sumbernya

0 komentar:

Posting Komentar