NEW YORK (CNNMoney)

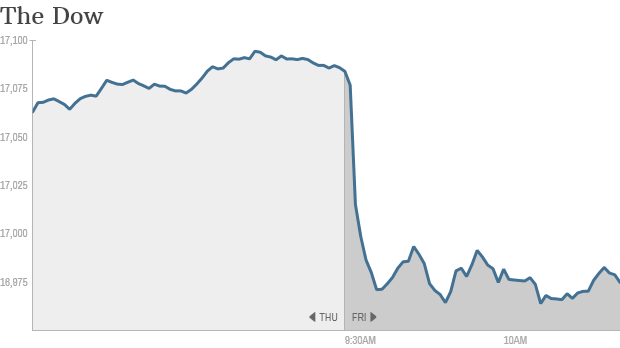

The S&P was down about 0.3% in mid-morning trading. The Dow was down more than 100 points, or 0.7%.

A 4% drop In Visa (V), which has the biggest weighting in the Dow, weighed down the blue chips.

The Nasdaq fell too, largely due to a more than 11% drop in Amazon (AMZN, Tech30) following its latest earnings.

Here's what you need to know.

Amazonian drought: Amazon's sales jumped more than 20% but it also reported a $123 million loss. Some investors may be growing tired of Amazon's long history of quarters where it loses more than expected due to big investments.

The company has been spending a lot this quarter, unveiling products and services like the Fire TV, Fire Phone and Sunday delivery, but it seems that's not enough to keep some investors around until next quarter.

Related: See how Amazon compares to other companies in CNNMoney's Tech30

IPO Loco: Today's the first day of trading for El Pollo Loco (LOCO), whose shares priced at $15 per share, the higher end of its IPO range.

The company has a lot of debt and isn't exactly Chipotle (CMG), but it has ambitious expansion plans and healthy IPO market behind it. The stock is up 28% so far.

Related: Are healthy chicken and a tiny profit enough to take El Pollo Loco nationwide?

A few other companies are due to debut today, but it remains to be seen if they have El Pollo Loco's spark: Orion Engineered Carbons (OEC) is flat, and Ocular Therapeutix (OCUL) and Innocoll (INNL) haven't started trading yet.

Cynk sinks: Cynk Technology (CYNK), the mysterious social network with no earnings, revenue or even assets, is once again trading after the SEC suspended trading two weeks ago following a from-nowhere 25,000% price increase. The stock was down more than 80% in late morning trading.

Related: Three takeaways from the Cynk stock blowup

Fox aims sky-high: 21st Century Fox (FOXA) merged its BSkyB cable assets in Germany and Italy with BSkyB in England, freeing up $8.3 billion in cash. The market thinks that the money might be put to use to help Rupert Murdoch's Fox make a higher bid for Time Warner (TWX), which Fox has sought to buy for $80 billion. Time Warner turned down the offer. Fox and Time Warner shares were flat Friday.

Related: Time Warner shares skyrocketed when Murdoch's offer went public

Other stock movers: Visa is having the second-worst day in the S&P 500 behind Amazon. It's down more than 4% in mid-morning trading. It had a great quarter that exceeded expectations and even spurred a number of price target upgrades from analysts. But it lowered its revenue growth forecast, and it's getting punished. Rival MasterCard (MA), whose earnings come out in a week, is down 2%.

Starbucks (SBUX) is also out with a good quarter that doesn't seem to be swaying investors. Its shares are down 2%. StockTwits trader pcbleyer wrote that the move was "irrational" given that the outlook from CEO Howard Schultz still seems healthy.

International Markets: The Russian central bank had to raise interest rates to lure foreign investors amid sanctions related to its aggression around Ukraine and high inflation. The main RTS index is down more than 1.65% so far today.

Related: Russia is paying a higher price for isolation

Asian markets ended the day mixed, but Japanese stocks surged 1.13% after data shows inflation may finally be returning to the long-dormant economy. European stocks are broadly lower in afternoon trading, with the FTSE 100 down about 0.2%.

First Published: July 25, 2014: 9:57 AM ET

Anda sedang membaca artikel tentang

TGIF? Nope. Stocks fall on earnings woes

Dengan url

http://kasiatbuatsehat.blogspot.com/2014/07/tgif-nope-stocks-fall-on-earnings-woes.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

TGIF? Nope. Stocks fall on earnings woes

namun jangan lupa untuk meletakkan link

TGIF? Nope. Stocks fall on earnings woes

sebagai sumbernya

0 komentar:

Posting Komentar