NEW YORK (CNNMoney)

The Dow Jones Industrial Average is around 20 points lower in early trading. Many hope this could be the week the Dow cross the 17,000 mark for the first time, but it's not looking promising today. It's largely a psychological barrier, but it illustrates that the index has continued unabated the bull run that saw it close above 16,000 for the first time just seven months ago.

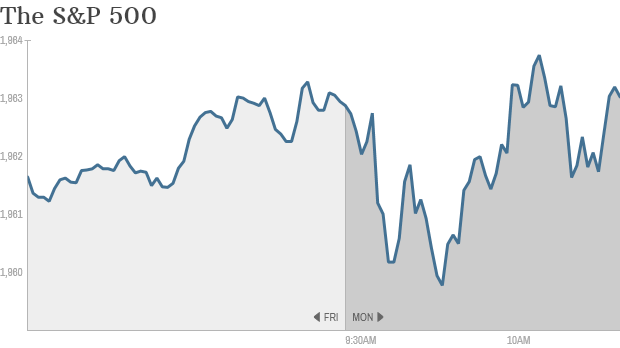

The S&P 500 and the Nasdaq are flat to slightly lower.

Related: What does Dow 17,000 mean, anyway?

Here are the top things to watch in today's trading:

1. Turmoil in the fashion industry -- Lululemon & American Apparel: Lululemon shares are bouncing this morning after the Wall Street Journal reported that the company's founder Chip Wilson hired Goldman Sachs to help him strengthen his role at the company, where he is the largest shareholder. Lululemon (LULU) shares are up over 2%

American Apparel (APP) shares are over 1% higher this morning on rumors that the company make be a potential takeover target. It's the latest twist impacting the brand. Last week the company fired controversial CEO Dov Charney. Now Charney has fired back, writing a letter to the board challenging his dismissal. The company continues to struggle to turn around its brand. The stock is trading for less than $1.

2. Real estate picks up: The National Association of Realtors released data Monday showing that pace of May existing home sales rose to 4.89 million a year, which is above the market's expectations for an annual rate of 4.73 million. Homebuilder stocks like Toll Brothers, (TOL) PulteGroup (PHM) and Lennar (LEN) and all positive.

The NAR said that May's uptick, at nearly 5%, was the fastest month-to-month growth since August 2011.

"Home buyers are benefiting from slower price growth due to the much-needed, rising inventory levels seen since the beginning of the year," said Lawrence Yun, the NAR's chief economist. "Moreover, sales were helped by the improving job market and the temporary but slight decline in mortgage rates."

3. Big deal for Micros: The computer giant purchased MICROS Systems (MCRS), one of its largest customers, for more than $5 billion. Micros specializes in providing software applications to the hospitality and retail sectors, and has worked with Oracle for more than 15 years. Oracle shares are flat, and Micros stock is up 3%.

4. Oh la la -- GE finally snags French prize: General Electric (GE) has finally closed the deal on French company Alstrom (ALSMY) to the tune of $17 billion, much more than its initial $13.5 billion bid. The French government had opposed the deal because it was concerned the merger would lead to job losses and a dilution of Alstom's French Brand. GE stock is down 1%, as are Alstom's French shares.

5. Buying power in energy stocks: Wisconsin Energy (WEC) announced this morning that it will acquire Integrys Energy Group (TEG) for for $71 per share in order to increase its natural gas business and its footprint in the Great Lakes region. Wisconsin's stock is flat, and Integrys shares have jumped over 14% to nearly $70.

6. BNP Paribas on verge of settlement with U.S.: The bank is on the cusp of a $9 billion settlement with the U.S. Justice Department on allegations that it did business with off-limits countries. The French bank's shares are flat at the moment.

Related: The fine could hurt BNP's credit rating

7. Oil prices: As fighting in Iraq intensifies and Israel continues launching rockets into Syria in retaliation for the killing of an Israel teen, keep an eye on oil prices. After a steady rise last week, WTI crude oil has backed away from the $107 barrier and is now down 0.4% for the day. It's been near that mark for a few days, but any increase in oil that could affect gas prices won't be welcome news amid America's peak driving season.

Related: Rising oil prices trigger economic growth concerns

8. International Markets: European stocks are largely down, with the FTSE 100 down slightly in afternoon trading. Asian markets are also a mixed bag, as are Chinese stocks are doing well after the country's manufacturing showed its first expansion in six months. The Hang Seng fell 1.7%, but shares traded in Shenzen were up nearly 1.1%.

First Published: June 23, 2014: 10:08 AM ET

Anda sedang membaca artikel tentang

Iraq, oil price fears spook market

Dengan url

http://kasiatbuatsehat.blogspot.com/2014/06/iraq-oil-price-fears-spook-market.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Iraq, oil price fears spook market

namun jangan lupa untuk meletakkan link

Iraq, oil price fears spook market

sebagai sumbernya

0 komentar:

Posting Komentar