NEW YORK (CNNMoney)

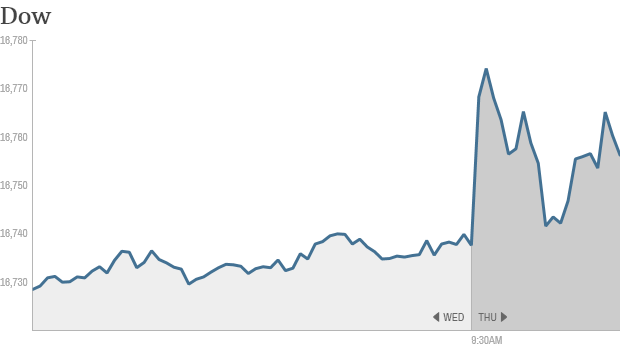

Both the Dow Jones industrial average and S&P 500 opened at fresh record highs on Thursday following the ECB's unprecedented decision to enact negative interest rates. The Nasdaq looked to build on Wednesday's advance with modest gains.

Here are four things you need to know about the global markets on Thursday:

1. All eyes on ECB: U.S. capital markets tend to take their cues from Janet Yellen & Co. at the Federal Reserve, but recently they've been moved by Mario Draghi's efforts to breathe life into the European economy.

Hoping to encourage inflation and spur bank lending, the ECB cut interest rates, as expected, to a record low and set a negative deposit rate on Thursday.

The negative rate is meant to penalize banks that decide to park their cash at the central bank instead of lending it out to businesses and consumers. But it's not like Draghi has a credible playbook to follow to avoid unintended consequences -- the ECB is the first major central bank to move into negative territory.

Still, investors liked the moves as European markets shook off an earlier malaise and moved higher following the ECB decision.

Related: ECB cuts rates

2. Surprise! More records: Both the Dow and S&P 500 posted all-time intraday highs in morning trading. The Dow climbed as high as 16,774.2, while the S&P 500 hit 1,931.19.

Record territory has become commonplace on Wall Street. A higher close would leave the S&P 500 with its 17th record close of the year. Still, it's worth noting the index is still trading below its all-time inflation-adjusted highs

Related: These stock market 'records' aren't that great

3. GM in the spotlight: General Motors (GM) is set to release the findings of its internal investigation into the ignition switch defect and massive recall today.

GM has issued recalls for 2.6 million cars over a technical problem linked to the deaths of at least 13 people. In total, GM has recalled 15.8 million vehicles worldwide this year.

GM CEO Mary Barra pledged to do the "right thing" for victims and said the auto maker fired 15 people for misconduct, incompetence or failure to act over the scandal. Barra said the report found a pattern of incompetence and neglect, but no conspiracy to cover up the defects.

Shares of the automaker rallied 3% of Wednesday, but are flat Thursday morning.

Related: Fear & Greed Index, still greedy

4. T-Mobile, Twitter & other movers: Should Twitter (TWTR, Tech30) follow Apple's (AAPL, Tech30) lead into music? Investors apparently believe so. Shares of Twitter climbed 2% after the Financial Times reported Twitter recently considered acquiring online music services Soundcloud, Spotify or even Pandora (P) in a bid to find new sources of growth.

Meanwhile, T-Mobile (TMUS) dropped over 2% amid reports the company and Sprint (S) are once again moving towards a potential marriage -- in the face of serious regulatory skepticism. While a deal could be blocked by antitrust or telecom regulators, the No. 3 and No. 4 wireless providers feel they need to team up to compete with industry leaders AT&T (T, Tech30)and Verizon (VZ, Tech30).

Shares of Ciena (CIEN) surged 15% after the company unveiled a bullish outlook for the second half of 2014. Ciena's quarterly profits and sales also exceeded Wall Street's expectations.

Related: CNNMoney's Tech30

J.M. Smucker (SJM)rallied almost 2% after reporting a lower drop in profits and sales than analysts had feared. The maker of Folgers was hurt by lower coffee prices and earlier this week announced plans to raise the price of its coffee products by 9%.

5. Earnings and economic data: The Labor Department said 312,000 Americans filed for unemployment benefits last week, up from 304,000 the week before.

But Wall Street is already looking ahead to Friday's all-important jobs report, which economists surveyed by CNNMoney predict will show the U.S. added 200,000 jobs in May. The unemployment rate is expected to tick up to 6.4%.

First Published: June 5, 2014: 9:54 AM ET

Anda sedang membaca artikel tentang

ECB pushes U.S. stocks to fresh records

Dengan url

http://kasiatbuatsehat.blogspot.com/2014/06/ecb-pushes-us-stocks-to-fresh-records.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

ECB pushes U.S. stocks to fresh records

namun jangan lupa untuk meletakkan link

ECB pushes U.S. stocks to fresh records

sebagai sumbernya

0 komentar:

Posting Komentar