Click the chart for more markets data.

NEW YORK (CNNMoney)

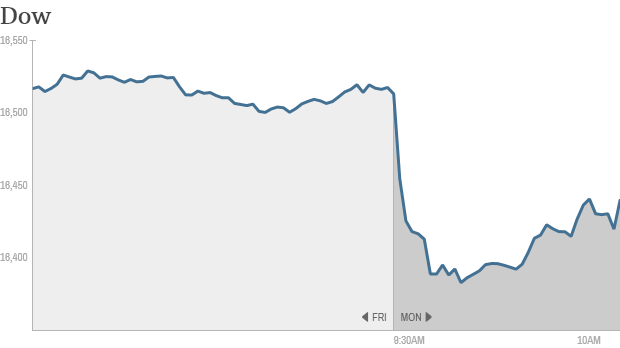

The Dow was down around 10 points Monday after dropping 120 points early in the trading session. The S&P 500 and Nasdaq also recovered from early losses, jumping into positive territory.

The latest reading from the CNNMoney Fear & Greed Index suggests investors are very fearful.

Related: All eyes on Janet Yellen this week

The early pessimism might have been drive by Target (TGT, Fortune 500)'s announcement Monday that Gregg Steinhafel, the chairman and CEO of Target during the retailer's massive breach of customer credit and debit card data last year, has left the company effective immediately. Chief Financial Officer John Mulligan will serve as interim CEO. Shares of the retailer slumped Monday.

Analyst Brian Sozzi of Belus Capital Advisors thought Target didn't move fast enough in removing Steinhafel.

"In truth, Mr. Steinhafel should have been pushed aside coming into the key spring selling season and before starting to set strategies for the upcoming holiday season of 2014," he said in a morning note.

Earnings season is winding down, but a few more quarterly releases remain on the docket this week. Tyson Foods (TSN, Fortune 500) shares dove after the company reported first quarter earnings that fell short of analyst estimates.

Pfizer (PFE, Fortune 500) sank after the pharmaceutical giant reported slightly better than expected earnings, but it's clear the company is struggling in its traditional drug business. That might explain why Pfizer is so keen to buy British pharmaceutical company AstraZeneca (AZN) despite that company's rejection of Pfizer's most recent offer of $106 billion on Friday.

Related: AstraZeneca says no to Pfizer's $106 billion bid

JP Morgan (JPBEX) shares dipped Monday after the nation's largest bank by assets said Friday that it expects a 20% drop in trading revenue in the second quarter. Like many of its rivals, the Wall Street behemoth has seen a sharp slowdown in its bonds, currencies, and commodities units as low interest rates and soft demand from emerging markets has put a damper on those previously lucrative businesses.

On a more positive note, shares of King Digital (KING), the maker of the hit online game Candy Crush, bounced Monday after Wall Street analysts began rating the stock. Many give it "buy" recommendations.

Salesforce.com (CRM)also got a boost after receiving a favorable rating from an analyst at Deutsche Bank.

Related: CNNMoney's Tech30

The three major indexes fell modestly on Friday, ending the week in the red. Still, the Dow hit an all-time high last week, and the S&P 500 is close to new heights.

European markets were lower in morning trading, as worries over growing tensions and lawlessness in Ukraine may be causing investors some unease. Germany, Russia's biggest European trading partner, saw its Dax index down by over 1% Monday.

Asian markets ended the day with mixed results, as monthly manufacturing data from China showed contraction in the world's second largest economy. Some international markets were closed Monday, including exchanges in London, Seoul and Tokyo. ![]()

First Published: May 5, 2014: 9:49 AM ET

Anda sedang membaca artikel tentang

Stocks: Bouncing back after early losses

Dengan url

http://kasiatbuatsehat.blogspot.com/2014/05/stocks-bouncing-back-after-early-losses.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: Bouncing back after early losses

namun jangan lupa untuk meletakkan link

Stocks: Bouncing back after early losses

sebagai sumbernya

0 komentar:

Posting Komentar