Click for more market data.

NEW YORK (CNNMoney)

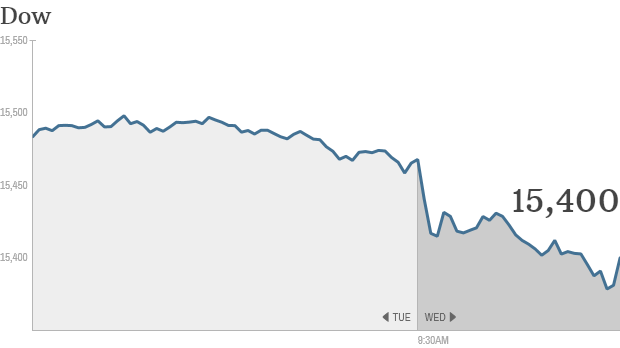

The Dow Jones industrial average, the S&P 500 and the Nasdaq were all down about 0.5% in early trading.

The S&P 500 hit a new peak Tuesday after a disappointing jobs report for September fueled expectations that the Federal Reserve will delay plans to scale back its massive bond-buying program until 2014.

But the momentum faded Wednesday as investors sifted through a raft of mixed reports from Corporate America.

"Earnings are certainly the focus," said Art Hogan, managing director at Lazard Capital Markets. "On balance, we've had more bad news than good news over the last 24 hours."

Investors were also grappling with "global macro issues," he added. Chinese stocks fell sharply on concerns about rising money market rates and risky bank lending. European markets were under pressure after the European Central Bank said banks would be subjected to more stringent stress tests.

However, Hogan said the retreat was not surprising given the recent rally. Stocks have gained for the past five days in a row.

Related: More banks in the crosshairs after JPM deal

A mixed bag of earnings: Dow component Caterpillar (CAT, Fortune 500) reported a slump in sales and earnings, noting that a slowdown in the mining sector has taken a bite out of heavy equipment manufacturing. Caterpillar shares were down nearly 6%.

But Boeing (BA, Fortune 500), which is also in the Dow, rose 5% after the company reported a surge in quarterly profit and revenue as the aircraft manufacturer works its way through a backlog of orders. It appears the government shutdown did not have a big impact on defense contractors. Rival Northrop Grumman (NOC, Fortune 500) reported earnings and sales above expectations and raised its outlook for the year.

Lockheed Martin (LMT, Fortune 500) also reported strong results on Tuesday, sending its stock sharply higher.

Shares of Broadcom (BRCM, Fortune 500) plunged 7% after the chipmaker said Tuesday that sales will be below analysts' expectations in the fourth quarter.

AT&T (T, Fortune 500) is scheduled to report after the close.

So far, 80 of the 130 S&P 500 companies have beat expectations, according to S&P Capital IQ. But many analysts still expect relatively weak earnings for the rest of the year.

Related: Fear and Greed index is getting greedy

Shares of Corning (GLW, Fortune 500) rallied after the company announced a $2 billion stock buyback, as well as a deal to take full control of a partnership with Samsung Display, which manufactures LCD glass used by makers of smartphones and tablets.

Netflix (NFLX) shares bounced back from a sharp decline Tuesday, even though hedge fund manager Carl Icahn revealed late Tuesday that he had reduced his stake in the company. ![]()

First Published: October 23, 2013: 9:49 AM ET

Anda sedang membaca artikel tentang

Stocks slip as investors focus on earnings

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/10/stocks-slip-as-investors-focus-on.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks slip as investors focus on earnings

namun jangan lupa untuk meletakkan link

Stocks slip as investors focus on earnings

sebagai sumbernya

0 komentar:

Posting Komentar