Click the chart for more stock market data.

NEW YORK (CNNMoney)

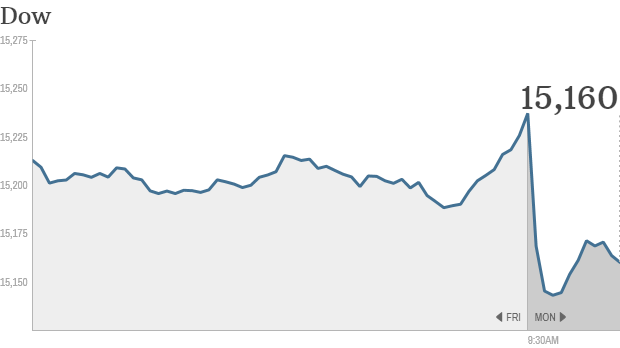

The Dow Jones industrial average, S&P 500 and Nasdaq declined about 0.5% in early trading Monday. The sell-off erased some of last week's huge gains, when the Dow rallied 460 points over Wednesday, Thursday and Friday.

"Just when you thought it was safe to assume progress on the budget impasse, the weekend has proved to be frustratingly slow in terms of positive developments," wrote Deutsche Bank analyst Gael Gunubu, in a client note. "Markets are responding accordingly ... as last week's hope that we would see an early-week deal has evaporated."

Related: Click here for more on stocks, bonds, currencies and commodities

Though markets have held up reasonably well thus far, investors could grow more rattled in the run-up to Thursday -- when the Treasury Department has warned it may run out of money to pay all government bills.

"We believe this foolish game of chicken shows Washington lawmakers have a naïve sense of the economy and global markets," said Craig Johnson, technical market strategist at Piper Jaffray.

Johnson said ongoing "saber rattling in Washington" will likely increase market volatility this week. But he continues to believe that "neither party in Washington is foolish enough to let the U.S. default on its debt."

Related: Investors still gripped by fear

The U.S. bond market is closed Monday for Columbus Day. But the rest of the week could be bumpy.

In the past week, investors have bailed out of short-term Treasury bills, sending yields spiking. T-bills are typically used by managers of money market funds as a risk-free means of stashing cash for short periods of time.

Related: U.S. chastised over debt ceiling

What's moving: Shares of Netflix (NFLX) gained ground following reports that it is in talks with Comcast (CMCSA, Fortune 500) and other cable providers to add its streaming video service as an app on set-top boxes.

Expedia (EXPE) shares took a tumble after being downgraded to hold from buy by Deutsche Bank.

Facebook (FB, Fortune 500) edged lower after the company said it will buy Tel Aviv-based start-up Onavo, which focuses on data compression and mobile analytics. The details of the deal were not disclosed. The purchase also gives Facebook its first office in Israel.

World markets: European markets were mostly weaker in afternoon trading, reflecting anxiety about the possible fallout from the U.S. political stalemate on the world economy and markets.

Most Asian markets were closed Monday. But the Shanghai Composite index was open, and finished the trading day with a 0.4% gain. ![]()

First Published: October 14, 2013: 9:47 AM ET

Anda sedang membaca artikel tentang

Here we go again: Stocks fall on no debt deal

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/10/here-we-go-again-stocks-fall-on-no-debt.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Here we go again: Stocks fall on no debt deal

namun jangan lupa untuk meletakkan link

Here we go again: Stocks fall on no debt deal

sebagai sumbernya

0 komentar:

Posting Komentar