Click for more market data.

NEW YORK (CNNMoney)

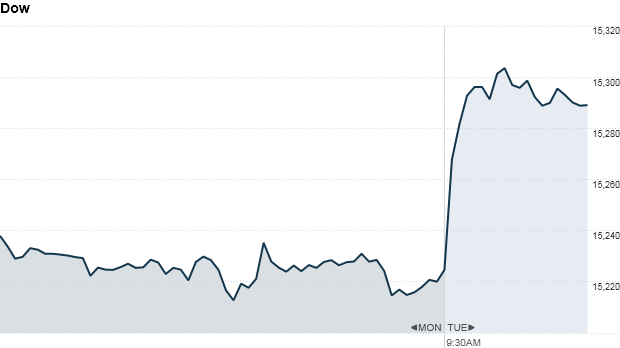

The Dow Jones industrial average and the S&P 500 and both gained about 0.4%. The Nasdaq was up 0.1%.

After Monday's close, Alcoa (AA, Fortune 500) became the first Dow component to report second-quarter results, topping analysts' forecasts.

Alcoa's results combined with lingering sentiment from last week's better-than-expected jobs report helped support stocks, said Anthony Conroy, head trader at BNY ConvergEx Group.

Firms including Yum! Brand, (YUM, Fortune 500) JPMorgan (JPM, Fortune 500) and Wells Fargo (WFC, Fortune 500) are set to report quarterly results later this week.

Overall, earnings for companies in the S&P 500 are expected to grow 0.8% versus last year, according to FactSet.

Click here for more data on bonds, commodities and currencies

U.S. stocks closed higher Monday as investors put aside concerns about the Federal Reserve slowing down its massive bond buying program, which would remove some liquidity from the markets.

But the focus could shift back to the Fed Wednesday, when the central bank releases minutes from its most recent policy meeting and chairman Ben Bernanke makes a speech in Cambridge, Mass.

Economy stuck in neutral. The International Monetary Fund cut its world economic growth forecast for the third time this year due to slowing emerging markets and a prolonged recession in the eurozone.

In an update to its World Economic Outlook, the IMF said Tuesday that it now expects world output to expand by just 3.1% in 2013, down from 3.3% in April. In January, it was forecasting growth of 3.5%.

Related: Fear & Greed Index driven by fear

What's moving. Tesla Motors (TSLA) is joining the Nasdaq-100 and replacing software company Oracle (ORCL, Fortune 500). The electric car maker's stock rose 3% to trade above $125. That's more than four times what the stock was worth at the beginning of the year.

Barnes & Noble (BKS, Fortune 500) shares sank after the book retailer announced that CEO William Lynch was resigning.

Shares of Intuitive Surgical Inc. (ISRG) plunged after the surgical robotics company pre-announced results that disappointed investors.

Shares of Kroger (KR, Fortune 500) rose to an all-time higher after it agreed to buy rival Harris Teeter (HTSI) in an all-cash deal valued at $2.5 billion.

NYSE Euronext (NYX) won a contact to take over Libor, the London interbank offered rate that has been at the epicenter of a wide-ranging bid rigging scandal.

European markets were broadly higher in morning trading, with shares in London leading the region. London's benchmark FTSE 100 index and the DAX in Germany were up by nearly 1%.

The U.K. pound came under pressure after data on British industrial production and manufacturing came in weaker than expected.

"Global investors continue to ride the wave of optimism painted by the stronger U.S. jobs data out on Friday together with the Bank of England and European Central Bank pledging to stand behind easing measures," said market strategist Ishaq Siddiqi from ETX Capital.

Asian markets ended Tuesday with gains. Japan's Nikkei surged 2.6% as it recovered from a fall on Monday. But gains in China were more modest after a report on inflation came in higher than expected. China's CPI jumped to 2.7% in June, up from 2.1%. ![]()

First Published: July 9, 2013: 9:40 AM ET

Anda sedang membaca artikel tentang

Stocks buoyant as earnings get underway

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/07/stocks-buoyant-as-earnings-get-underway.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks buoyant as earnings get underway

namun jangan lupa untuk meletakkan link

Stocks buoyant as earnings get underway

sebagai sumbernya

0 komentar:

Posting Komentar