Click chart for more market data

NEW YORK (CNNMoney)

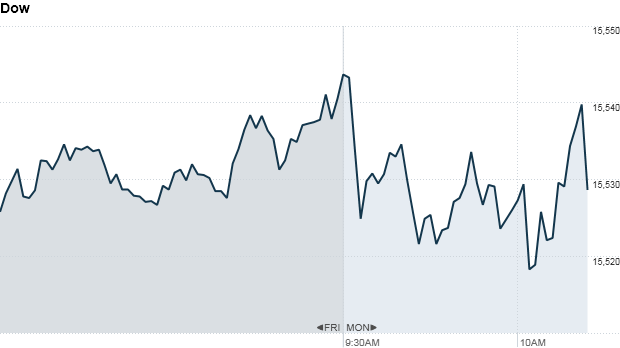

The Dow Jones industrial average was down a handful of points. McDonald's (MCD, Fortune 500) was the main drag, falling 2.5% after the restaurant operator reported disappointing earnings and sales.

The S&P 500 was little changed. The Nasdaq edged up 0.1%.

Nearly 160 companies in the S&P 500 are slated to report quarterly results this week. Among the Dow components set to report this week are AT&T (T, Fortune 500), Boeing (BA, Fortune 500), and 3M (MMM, Fortune 500).

While investors were hitting the pause button Monday, stocks have had quite a year. All three indexes are up roughly 19%, and both the Dow and S&P 500 hit new record highs last week.

Click here for more on stocks, bonds, currencies and commodities

Broad boost from earnings: While it's still early, the second-quarter earnings have come in better than many had feared.

The results so far "have provided support to stock prices and given a boost to investor sentiment," said John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, adding that expectations had been cut in the run-up to the reports.

Of the 104 companies that reported results through Friday, 66% have beat analysts' expectations, according to S&P Capital IQ.

Much of that performance was driven by the financial services sector, which benefited from robust capital market activity in the second quarter.

Kimberly-Clark (KMB, Fortune 500), producer of Kleenex, Huggies, Kotex, Depends and Scott products, reported an increase in quarterly profit but sales were flat.

Six Flags (SIX) shares fell after the amusement park operator said earnings slumped 26% in the second quarter. The company is also struggling with the fallout from a fatal roller coaster accident over the weekend.

Tech results in focus: This week, a number of big technology companies are slated to report, including Apple (AAPL, Fortune 500), Facebook (FB) and Amazon (AMZN, Fortune 500).

Following disappointing results from Google (GOOG, Fortune 500) and Microsoft (MSFT, Fortune 500)last week, investors are eager to see how other tech companies have fared. Apple, which can have an out-sized impact on the broader market, is expected to report a sharp drop in profits.

Netflix's (NFLX) report is due after the close.

Despite the positive tone to last week's earnings reports, many investors remain concerned about the tepid pace of revenue growth, said Dan Greenhaus, chief market strategist at BTIG.

"Revenue growth concerns are paramount, with some wondering about the future path of earnings if revenue growth doesn't accelerate," Greenhaus wrote in a note to clients.

He said about half of the companies that have reported so far have beat revenue expectations, which is below average.

Related: Fear & Greed Index, still greedy

In other corporate news, Yahoo! (YHOO, Fortune 500)announced that it will repurchase 40 million Yahoo shares from long-time backer Third Point Capital. The hedge fund, run by activist investor Dan Loeb, will retain a small stake.

UBS (UBS) agreed to pay about $745 million to settle a case with the U.S. Federal Housing Finance Agency over improperly selling mortgage-backed securities to Fannie Mae and Freddie Mac in the United States.

Gold boost: Shares of mining companies were higher as the price of gold rose more than 2% to trade above $1,300 an ounce.

Barrick Gold (ABX), Newmont Mining (NEM, Fortune 500), Kinross Gold (KGC) all gained about 4%.

In economic news, the National Association of Realtors said new home sales fell 1.2% in June. The group blamed higher mortgage rates in certain high-end markets .

World markets: In Europe, the major indexes were mixed in midday trading.

Asian markets ended with mixed results. Japan's Nikkei advanced by 0.5% after voters rewarded the architects of Abenomics with a sweeping electoral victory.

"Japan now has no election planned for the next three years, suggesting Abenomics will be here to stay for some time," wrote Reid. "Politics aside, the next test for Abe's economic agenda is Japanese corporate profitability, with the domestic earnings season kicking off this week." ![]()

First Published: July 22, 2013: 9:43 AM ET

Anda sedang membaca artikel tentang

Stocks: Bracing for earnings deluge

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/07/stocks-bracing-for-earnings-deluge.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: Bracing for earnings deluge

namun jangan lupa untuk meletakkan link

Stocks: Bracing for earnings deluge

sebagai sumbernya

0 komentar:

Posting Komentar