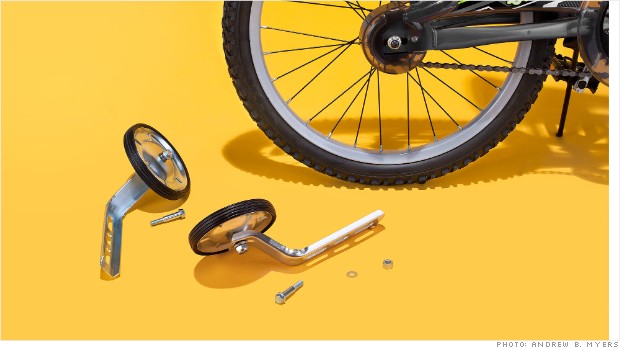

When the Fed's training wheels come off and yields turn around, position yourself to take advantage of higher rates.

(Money Magazine)

Look at what happened in late May and June after chairman Ben Bernanke said the Fed would, eventually, assuming things get better, start to pare back its aggressive efforts to keep credit flowing. The rally on the Dow, which not long ago had crossed 15,000, pulled back sharply. Treasury rates jumped to a 20-month high by late June. (When yields go up, bond prices go down.)

For bond fund investors, the sell-off meant "their worst month since the Greek financial crisis," according to Lipper analyst Jeff Tjornehoj.

How can so much hang on the ambiguous words of one economist? As you'll see, the Fed has played such an extraordinarily large role in markets since the 2008 crisis that professional traders have a lot of short-term money riding on Bernanke's next move.

Behind all that, though, there's a big issue for long-term investors too. The Fed is suggesting that the economy is finally headed to a healthy new phase, one that doesn't need an extra push from central bankers. The portfolio that worked in the post-2008 emergency years is likely to be a poor fit for what comes next.

Below are answers to the three biggest questions raised by the market's latest Fed frenzy.

What exactly is the Fed doing?

Ordinarily the Fed tries to influence the economy by setting short-term interest rates, cutting them to stoke growth or raising them when inflation looms.

But after the financial crisis, even driving short-term rates essentially to zero didn't do enough to invigorate growth. So the Fed stepped into markets in a bigger way. It bought up trillions of dollars of fixed-income investments, including long-term Treasury bonds and mortgage-backed securities.

Economists have endless debates about how (not to mention how much) this "quantitative easing," or QE, helps the economy. One idea is that it pushes yields on safe-haven assets so low that would-be buyers look instead to riskier investments like junk bonds and stocks, making individual investors feel richer and, it is hoped, more willing to spend and invest.

At least as important, though, is the message such unprecedented intervention sends. "The Fed signaled it was committed to supporting the economy," says Moody's Analytics economist Nate Kelley. "It reassured the markets."

Given both the Fed's big position in bond markets and the complex mental chess games it plays with investors, it's not hard to see why Wall Street has been so skittish lately.

The Fed's intervention can't go on forever. Bernanke's reminders of this have been mild: He hasn't said he'd reverse QE, just slow it.

Still, that's enough to get traders pondering whether other investors want to own risky assets without the Fed's implicit encouragement. "Everybody is worried about what everybody else is doing," says BlackRock chief investment strategist Russ Koesterich. "Volatility is going to be hard to avoid."

Will a Fed shift crush stock market gains?

No one likes to sit through wild up-and-down markets. The important thing for long-term investors to remember, however, is the reason the Fed's talking about slowing QE at all: The economy is gradually looking better.

Unemployment, although still high, has fallen to below 8%, while other measures, such as household spending and the rate of home construction, have ticked up. And all this has happened without stoking inflation, which has hovered below 2%.

That means there's relatively little pressure for the Fed to aggressively choke off growth to keep prices under control.

Related: Stocks that can rise with rates

All that sounds like good news to some Wall Street bulls. They've been arguing that once lingering financial-crisis angst fades, stocks are poised to take off much the way they did in the early 1980s when investors finally overcame the trauma of the Carter-era inflation and oil shocks.

"It's almost a mirror image" of that time, says Oppenheimer chief market strategist John Stoltzfus. He predicts that the Standard & Poor's 500 could climb another 9% by year-end.

That's the bull case. Now for the caveats: First, Bernanke and the Fed could be wrong about the outlook for growth -- they have been before -- and as a result tighten much too early. Second, even if the economic situation bodes well, much of the good news may already be factored into today's prices, thanks to the Fed's prodding.

With the market up about 20% in the past year, stocks have been trading at about 14 times their expected profits over the next year. That's more or less in line with the historical average. This doesn't augur a terrible bear market, but it does suggest more modest long-term gains ahead.

Compared with what appears to be ahead for bonds, however, modest stock gains would count as banner news.

How risky are bonds now?

As the economy gets better, the Fed should allow longer-term interest rates to rise above their historically low levels. Those rates aren't set directly by the Fed, but by the bond market, so things could happen quickly once traders are convinced that the Fed's outlook has shifted and demand higher yields. Since rising yields mean falling prices, investors in bond mutual funds and ETFs could face sharp losses.

Related: Higher mortgage rates won't hurt recovery, Fannie finds

Some have already had a taste of this: When the yield on the 10-year Treasury jumped from 1.66% in early May to 2.41% in mid-June, long-term bond funds lost about 6% of their value.

Janney Montgomery Scott chief fixed-income strategist Guy LeBas expects rates to continue rising; even assuming sluggish economic growth, his firm forecasts rates at 2.7% next year. With yields so low, "it's a lot easier to go up than down," he says.

You can estimate how sharp your losses would be on your bond funds by looking at a statistic called duration. (Find it on the fund quote page at Morningstar.com.) A portfolio with a duration of six years -- about middle of the road for bond funds -- would see a drop of 6% if interest rates rise one percentage point.

This doesn't mean you should forgo fixed income in favor of stocks -- although bonds look risky now, that doesn't make stocks safe. The wiser move is to shift to shorter-duration funds, and even cash or money-market accounts for money you can't afford to lose.

By staying short, you have to miss out on some yield now, at a time when income is painfully hard to get. But when the Fed's training wheels come off and yields turn around, you'll be well positioned to take advantage of higher rates. ![]()

First Published: July 19, 2013: 6:24 PM ET

Anda sedang membaca artikel tentang

Be set when the Fed's help ends

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/07/be-set-when-feds-help-ends_21.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Be set when the Fed's help ends

namun jangan lupa untuk meletakkan link

Be set when the Fed's help ends

sebagai sumbernya

0 komentar:

Posting Komentar