Click chart for more markets data.

NEW YORK (CNNMoney)

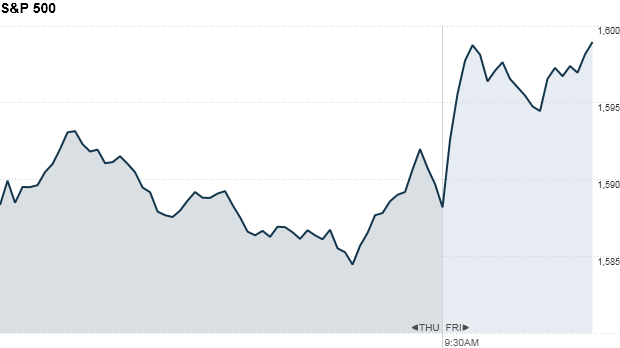

Investors were spooked after Fed chairman Ben Bernanke gave them reason to think the central bank could wind down its stimulus program later this year. Shares fell sharply Wednesday afternoon and the pullback accelerated Thursday.

But with little news to trade on heading into the weekend, it appears investors were willing to step back into stocks. The Dow Jones Industrial Average and the S&P 500 rose between 0.3% and 0.4%.

The Nasdaq dipped 0.1%. Weak results from Oracle (ORCL, Fortune 500) dragged down the tech-heavy index.

Click here for more on bonds, currencies and commodities

Even after this week's sell-off, stocks are still way up this year. All three major U.S. indexes have gained between 11% and 13%.

The Fed has been a major driver of the bull market over the past few months as it has injected liquidity into the markets. Traders say the coming shift in monetary policy will mean even more volatility in the months ahead. The CBOE Market Volatility Index (VIX) surged 23% Thursday.

Investors are expecting an extra dose of volatility Friday. It's quadruple witching day. This eerie date occurs four times a year and is when four types of options contracts expire. It usually means that trading volume increases, and prices bounce around more.

Related: Fear & Greed Index firmly in extreme fear

U.S. government bond yields also remain at elevated levels. The 10-year Treasury yield was at 2.42% Friday morning.

Investors have been bailing out of bonds and sending yields higher over the past month amid speculation that the Fed will soon taper its monthly bond purchases, known as quantitative easing.

Gold has also been hit hard due to Fed tapering fears. But the metal bounced back Friday after a sell-off pushed gold below $1300 an ounce to its worst level in two and a half years.

European stock markets were mixed in midday trading, while Asian markets ended with mixed results.

Japan's Nikkei index posted a 1.7% bounce, closing the week with a gain of 4.3%.

Related: Don't panic! Selling now could hurt your nest egg

But Chinese stocks continued to head lower as investors worried about tighter liquidity conditions across the country and a slump in manufacturing activity.

Nomura said Chinese government policies seem to be the reason for the cash crunch.

"Since mid-March, the government has introduced a series of tightening measures in the shadow banking sector to contain financial risks," it said in a research note.

"The People's Bank of China could have reacted and injected liquidity through open market operations. Its decision not to intervene shows that it is committed to tightening the policy stance."

Related: U.S. dollar headed for 'multi-year rally'

In corporate news, shares of Facebook (FB) rallied Friday, one day after the social media giant rolled out its Instagram video product.

Darden Restaurants (DRI, Fortune 500), which operates chains including Red Lobster and Olive Garden, reported earnings that missed estimates, but a slightly better-than-forecast revenue increase.

Shares of CarMax (KMX, Fortune 500) soared after the auto retailer reported better-than-expected quarterly profits.

Inflight wireless company Gogo (GOGO) will begin trading Friday with shares priced at $17, the high end of its range. ![]()

First Published: June 21, 2013: 9:44 AM ET

Anda sedang membaca artikel tentang

What sell-off? Stocks stabilize.

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/06/what-sell-off-stocks-stabilize.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

What sell-off? Stocks stabilize.

namun jangan lupa untuk meletakkan link

What sell-off? Stocks stabilize.

sebagai sumbernya

0 komentar:

Posting Komentar