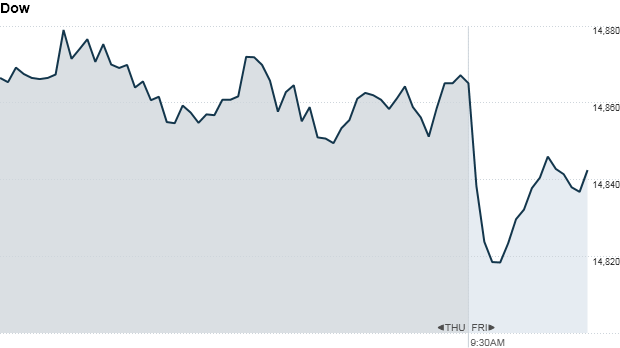

Click the chart for more stock market data.

NEW YORK (CNNMoney)

The Dow Jones industrial average and Nasdaq shed 0.3%, while he S&P 500 lost 0.4%.

Despite the step back, stocks are on track to finish the week sharply higher, and just below the record highs set Thursday. The Dow and S&P 500 are up about 2%, while the Nasdaq has gained almost 3% for the week.

Stocks have been on a tear this year. The Dow is about 1% away from 15,000, while the S&P 500 is only 0.8% below 1,600. There hasn't been any one catalyst pushing stocks higher lately. Mostly, investors just don't want to miss the next leg up.

Related: Fear & Greed Index gets greedy

Big banks report earnings: Investors focused on earnings Friday, as two big banks opened their books. JPMorgan Chase (JPM, Fortune 500) reported a first-quarter profit that topped forecasts, but revenue missed estimates. Similarly, Wells Fargo (WFC, Fortune 500) reported a jump in profit, but a decline in revenue. Shares of both banks edged lower.

The first quarter was expected to have been a tough one for banks, with interest rates hovering near record lows. Citigroup (C, Fortune 500), Bank of America (BAC, Fortune 500), Goldman Sachs (GS, Fortune 500) and Morgan Stanley (MS, Fortune 500) will report their results next week.

Related: Investors are back with a vengeance

No Easter bump for retail sales: On the economic front, the U.S. government reported that retail sales dropped 0.4% in March, dragged down by weakness in electronics and gasoline prices. Economists were expecting sales to be unchanged from February.

The Producer Price Index fell 0.6% in March, a more dramatic drop than the 0.1% economists had forecast. That's another sign that inflation is not a problem right now.

What's moving: J.C. Penney (JCP, Fortune 500) shares edged higher following reports that it hired Blackstone to help the retailer raise $1 billion.

In other corporate news, Nasdaq (NDAQ) executives will be getting their bonuses cut this year, and the bungled Facebook IPO is to blame.

European markets were lower in afternoon trading, as concerns about the mounting cost of the Cyprus bailout ended a four-day winning streak. London's FTSE 100 was down 0.4%, while the CAC 40 in Paris dropped 1.1% and the DAX in Frankfurt fell 1.5%.

Officials from the European Union and International Monetary Fund said they will not give Cyprus extra cash to plug the gaping holes in its finances.

Asian markets ended lower. The Shanghai Composite declined 0.6%, the Nikkei lost 0.5% and the Hang Seng dropped 0.1%.

The dollar gained ground versus the euro and the British pound, but fell versus the Japanese yen.

Oil and gold prices fell sharply.

The price on the 10-year Treasury rose, pushing the yield down to 1.75% from 1.79% late Thursday. ![]()

First Published: April 12, 2013: 9:47 AM ET

Anda sedang membaca artikel tentang

Stocks open lower after banks, retail sales

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/04/stocks-open-lower-after-banks-retail.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks open lower after banks, retail sales

namun jangan lupa untuk meletakkan link

Stocks open lower after banks, retail sales

sebagai sumbernya

0 komentar:

Posting Komentar