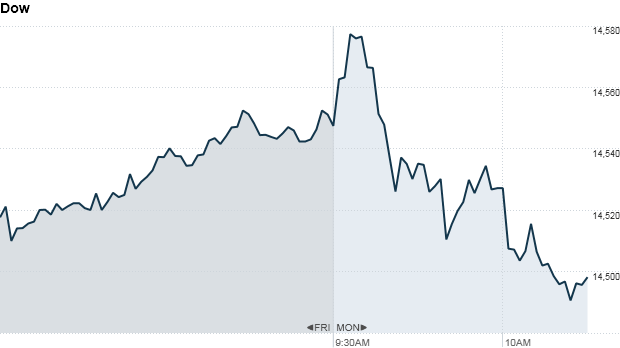

Click the chart for more stock market data.

NEW YORK (CNNMoney)

The Dow Jones industrial average and S&P 500 edged down 0.4%, while the tech-heavy Nasdaq slipped 0.2%.

Investors were disappointed after an industry report showed that existing home sales slipped 0.6% in March from the prior month, to a 4.92 million annual rate. Analysts expected the sales rate to rise.

Mixed company news was also drawing investors' attention.

The Dow's decline was led by a 2% drop in shares of General Electric (GE, Fortune 500) after JPMorgan Chase downgraded the stock to neutral.

Meanwhile, technology stocks were big gainers Monday. Shares of Microsoft (MSFT, Fortune 500) rose almost 4% after CNBC reported that hedge fund ValueAct was going to announce it was taking a $2 billion stake in the company. That would make ValueAct Microsoft's biggest shareholder.

Related: I lost $2,000 on Apple, but still betting on recovery

On the earnings front, Caterpillar (CAT, Fortune 500), considered a bellwether for the global economy because of its size and reach, missed profit and revenue forecasts. The mining and construction equipment maker also trimmed its earnings outlook for the year, citing a slowdown in mining. Despite the weakness, shares of the Dow component rose slightly higher.

Oil services firm Halliburton (HAL, Fortune 500) handily beat earnings and revenue estimates. The stock climbed more than 3%, making it among the top gainers in the S&P 500.

Shares of Netflix (NFLX) were up more than 3%. The company, which is hoping for a boost from its "House of Cards" video series, is on deck to report earning after the close.

Analysts expect earnings for S&P 500 companies to rise by 2% for the first quarter, according to S&P Capital IQ. But earnings season is far from over. So far, 104 S&P 500 companies have reported, with 70 beating forecasts, 23 missing and 11 coming in in line.

Aside from earnings, shares of Power One Inc. (PWER) surged more than 50% after Swiss company ABB (ABB) agreed to buy the solar power company in a $1 billion deal.

Related: Fear & Greed Index firmly in fear

Gold was also back in the spotlight. After last week's rout, the precious metal was up almost 2%, to $1,420 an ounce. That helped push the SPDR Gold Shares Trust ETF (GLD) up more thant 1%, and shares of gold miner Randgold (GOLD) spiked more than 3%.

European markets were higher in afternoon trading, supported by hopes that Italy may soon have a new government after President Giorgio Napolitano was elected for a second term. Asian markets were mixed, with the Shanghai Composite declining 0.1% and the Hang Seng adding 0.1%.

Japan's Nikkei rose 1.9% and the yen fell to almost 100 against the U.S. dollar after the G-20 gave its blessing to Japan's new monetary policy experiment.

The dollar rose against the euro, and was flat versus the British pound and the Japanese yen.

Oil priced edged slightly higher.

The price on the 10-year Treasury edged up, pushing the yield down to 1.69% from 1.70% late Friday. ![]()

First Published: April 22, 2013: 9:57 AM ET

Anda sedang membaca artikel tentang

Investors disappointed by housing report

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/04/investors-disappointed-by-housing-report.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Investors disappointed by housing report

namun jangan lupa untuk meletakkan link

Investors disappointed by housing report

sebagai sumbernya

0 komentar:

Posting Komentar