Click for more market data.

NEW YORK (CNNMoney)

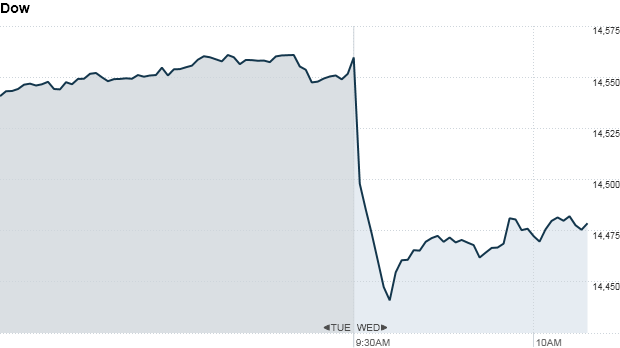

The S&P 500 and Dow Jones industrial average both fell about 0.5%. The Nasdaq declined 0.6%. Trading volume on Wall Street is likely to be thin amid the Passover holiday and ahead of Good Friday and Easter.

European markets were also down sharply, driven lower by the banking sector. Shares of Deutsche Bank (DB) fell 4% on a rumor that the German bank could have its credit rating downgraded, said Dave Rovelli, managing director of U.S. equity trading at brokerage Canaccord Genuity.

Bracing for bank run in Cyprus? Rovelli added that investors are concerned that there will be a bank run in Cyprus when banks reopen Thursday after being closed since March 16. Some form of capital controls will be applied when the banks eventually reopen. Details are due to be published later Wednesday.

The island nation agreed early Monday to raise billions of euros from big depositors at the Bank of Cyprus and Popular Bank of Cyprus, and to shrink its banking sector in return for a €10 billion European Union bailout.

Meanwhile, two reports from the European Union highlighted the gloomy economic and business outlook in Europe. The EU business climate indicator fell 0.14 points in March, extending a downturn that goes back to Sept. 2011. A separate survey showed that economic sentiment in Europe fell in March, while consumer confidence was little changed.

Also in Europe, British banks need to raise £25 billion, or about $38 billion, this year to buffer against the potential for future financial turmoil.

"Europe's getting demolished. The banks are getting crushed," said Rovelli. "That's weighing on our banks and taking down our markets, but we were due for a sell-off."

U.S. stocks finished higher Tuesday, with the S&P 500 less than two points away from its all-time closing high of 1,565.15, following better-than-expected reports on the U.S. economy and easing concerns about Cyprus. The Dow Jones industrial average hit a record closing high of 14,559.65.

A rare bit of weak news about home sales. On the economic front, the National Association of Realtors said pending home sales, a measure of purchases that have not yet closed, fell 0.4% in February. Economists had expected the index to have risen 2%, according to a Briefing.com consensus of economist forecasts.

NAR said the limited number of homes for sale in certain parts of the country was holding the market back. Despite the drop in February from March, the index is up 8.4% versus February 2012.

Related: Fear & Greed Index gets extremely greedy

Asian markets ended higher. The Shanghai Composite and Nikkei added 0.2%, while the Hang Seng advanced 0.7%.

However, worries over attempts to rein in runaway real estate prices and rapid growth in China have capped Chinese indexes so far this year, while Japanese stocks have soared.

In corporate news, shares of Cliffs Natural Resources (CLF, Fortune 500) were down nearly 12% in early trading. The stock, which has been the worst performer in the S&P 500 this year, was hit with two analyst downgrades Wednesday. ![]()

First Published: March 27, 2013: 9:41 AM ET

Anda sedang membaca artikel tentang

Stocks pull back from near record levels

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/03/stocks-pull-back-from-near-record-levels.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks pull back from near record levels

namun jangan lupa untuk meletakkan link

Stocks pull back from near record levels

sebagai sumbernya

0 komentar:

Posting Komentar