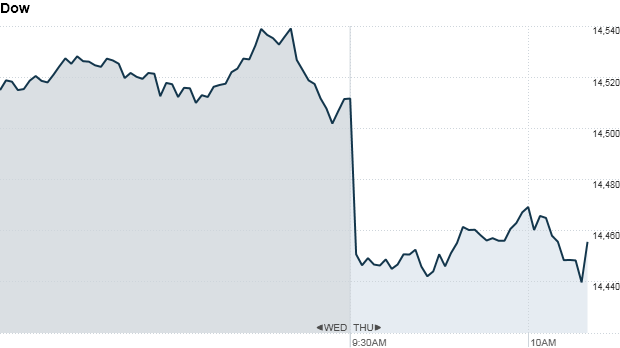

Click the chart for more stock market data.

NEW YORK (CNNMoney)

The Dow Jones industrial average and S&P 500 slipped 0.6%, while the Nasdaq fell 0.8%. The decline was broad, with all but two of the Dow's 30 components trading lower, and more than 80% of the S&P 500 in the red.

Oracle (ORCL, Fortune 500) was the biggest laggard in both the S&P 500 and Nasdaq 100. Shares of the software giant tumbled almost 10% after its third-quarter sales fell short of forecasts.

On the economic front, investors mulled over the latest readings on initial jobless claims, existing home sales and the Philly Fed's monthly business outlook.

Jobless claims totaled 336,000 last week, according to the U.S. Department of Labor. That's up 2,000 from the prior week, but less than the 345,000 claims forecast by Briefing.com consensus.

The National Association of Realtors said that existing home sales in February edged up 0.8% to an annual rate of 4.98 million, a 3-year high but slightly lower than expectations.

The Philly Fed's index rose to 2 in March from -12.5 the prior month. Readings lower than zero signal contraction in the area covering eastern Pennsylvania, southern New Jersey and Delaware. Economists were expecting a reading of -3 for March.

Related: 5 reasons the bull market has room to run

Also, a report on Chinese manufacturing showed activity expanded at a faster clip than expected by many economists, which may quell worries about China's economy slowing down.

While Cyprus continues to heat up, investors have become less concerned about contagion spreading to other financial markets. Early Thursday, the European Central Bank told the troubled nation it had until Monday to sort itself out or face the consequences of a potential financial collapse and/or exit from the euro.

Meanwhile, the latest bond auction in Spain drew strong demand, even as European markets trended lower in afternoon trading.

Related: Google vs. Apple. Which is your favorite?

Just days after recalling see-through yoga pants, lululemon athletica (LULU) reported earnings and sales that squeaked past estimates and said it was working closely with manufacturers to resolve the yoga pant issue. The company also said its current quarter and full year earnings would come in below analysts' forecasts.

KB Home (KBH) shares edged higher after the homebuilder reported that sales surged 59% in the first quarter, as more homes were delivered and prices increased.

Related: Fear & Greed Index edges into extreme greed

Asian markets ended mixed. The Shanghai Composite added 0.3% and the Nikkei increased 1.3%, while the Hang Seng declined 0.1%.

The dollar rose against the euro, but fell versus the British pound and the Japanese yen.

Oil prices edged lower, while gold prices gained.

The price on the 10-year Treasury rose, pushing the yield down to 1.93% from 1.94% late Wednesday. ![]()

First Published: March 21, 2013: 9:49 AM ET

Anda sedang membaca artikel tentang

Stocks: Investors step back

Dengan url

http://kasiatbuatsehat.blogspot.com/2013/03/stocks-investors-step-back.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: Investors step back

namun jangan lupa untuk meletakkan link

sebagai sumbernya

0 komentar:

Posting Komentar