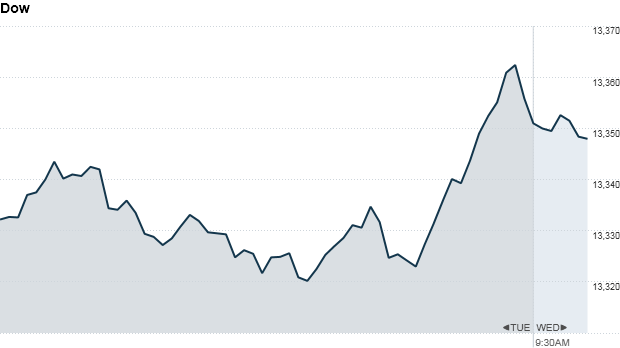

Click the chart for more stock market data

NEW YORK (CNNMoney)

As investors wait to see if a deal is taking shape, the Dow Jones Industrial Average, the S&P 500 and the Nasdaq were little changed as markets opened.

Investors apparently were willing to dismiss the latest warning from ratings agency Fitch Wednesday. Fitch reiterated it may strip the U.S. of its AAA credit rating if Washington is unable to strike a deal soon to avert the fiscal cliff and allow borrowing to rise.

Aside from the fiscal cliff talks, investors got an update on the nascent housing market recovery -- but November didn't bring good news. Ahead of the opening bell, the Census Bureau said housing starts fell 3% in November to an annual rate of 861,000.

Early Wednesday, UBS (UBS) said it will pay $1.5 billion to settle claims in the U.S., U.K. and Switzerland related to rigging Libor benchmark interest rates. The settlement was widely expected and shares of UBS rose on the news.

Also, the Treasury Department announced it will exit all of its investment in General Motors (GM, Fortune 500) within the next 12-15 months as part of its efforts to wind down its investments in the Troubled Asset Relief Program (TARP). Shares of GM were up more than 7% early Wednesday.

Trading firm Knight Capital (KCG) said it will merge with rival and partial owner Getco, just three weeks after Getco made its offer. Knight Capital stock gained 6.6% in early trading.

Related: America's Debt Challenge

In other corporate news, FedEx (FDX, Fortune 500) reported that earnings fell due to a weakened global outlook and the impact of Superstorm Sandy. FedEx is often viewed as a bellwether for the broader economy due to the nature and global scope of its business. But even though profits were down, they still topped forecasts. Shares of the shipping giant gained more than 2%.

Cereal maker General Mills (GIS, Fortune 500) posted better-than-expected quarterly earnings Wednesday morning as well.

After the closing bell Tuesday, tech giant Oracle (ORCL, Fortune 500) reported quarterly results that beat analysts' forecasts for profits and revenues. The stock was up 3%..

Fear & Greed Index

European markets shrugged off the UBS settlement news and remained higher in afternoon trading.

Most Asian markets ended broadly firmer, though the Shanghai Composite ended close to flat. Japanese stocks continued to lead the way on expectations of new measures to stimulate the economy. The Bank of Japan is expected to announce an increase in its asset-purchase program on Thursday.

The dollar was steady against most major currencies, and continued to gain against the yen, which has been hit by the talk of further monetary stimulus. ![]()

First Published: December 19, 2012: 9:48 AM ET

Anda sedang membaca artikel tentang

Stocks: Investors hold onto fiscal cliff hopes

Dengan url

http://kasiatbuatsehat.blogspot.com/2012/12/stocks-investors-hold-onto-fiscal-cliff.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: Investors hold onto fiscal cliff hopes

namun jangan lupa untuk meletakkan link

Stocks: Investors hold onto fiscal cliff hopes

sebagai sumbernya

0 komentar:

Posting Komentar