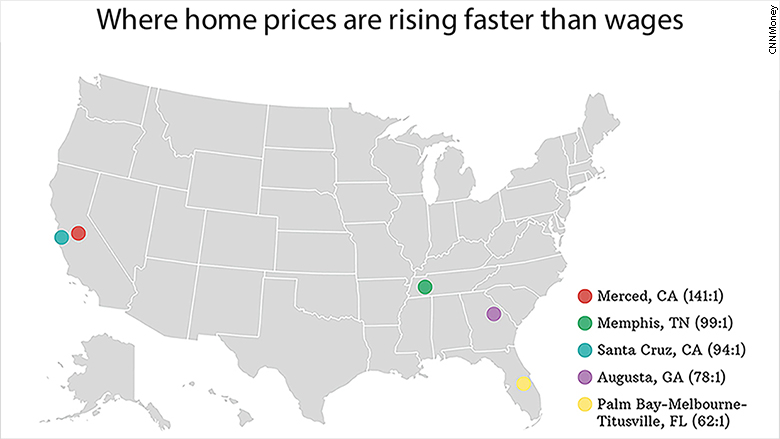

These markets have the highest ratio of price appreciation to wage growth, according to RealtyTrac.

These markets have the highest ratio of price appreciation to wage growth, according to RealtyTrac.

Home prices are rising 13 times faster than wage growth nationwide, according to a report from RealtyTrac. From 2012-2014, median home prices climbed 17% while median wages rose 1.3%.

"The bounce back has taken home prices in some markets out of reach of the ever-important first-time homebuyer we need to continue the momentum," said Daren Blomquist, vice president at RealtyTrac.

Home prices climbed faster than wages in 76% of the 184 markets analyzed.

While wages aren't keeping pace with home prices in many markets, low interest rates have helped keep buying a viable option, according to Blomquist. "It is a concerning trend, but the good news is we are at the juncture where it hasn't become a housing bubble yet. If the trend continues, we will be in a bubble in the next year or two."

He added that markets experiencing 30% or higher home price appreciation run the risk of becoming unaffordable for many buyers.

RealtyTrac used data from the Bureau of Labor Statistics from the second quarter of 2012 to the same time in 2014 to determine wage data, while median home prices were measured from sales deeds recorded in December 2012 and December 2014.

Tool: What will your mortgage payment be?

Merced, Calif., Memphis, Santa Cruz, Calif., and Augusta, Georgia were the markets with the highest ratio of price appreciation compared to wage growth, according to RealtyTrac.

On the flip side, wage growth was stronger than home price appreciation in 24% of the markets analyzed.

Sluggish wage growth has hit millennial-aged workers particularly hard, explained Patrick Newport, an economist at IHS Global, which has led to slower activity among first-time buyers. "Young people aren't playing as big of a role as they used to in the housing market, their real income is down ... and they have more student debt."

Related: Worst cities to be a renter

First-time buyers tend to purchase starter homes, which according to Blomquist, have faced the biggest deficit in inventory.

Homeowners who lost equity on their homes during the crash are likely cheering the rapid increase. At the height of the crash, 13 million people were underwater, said Blomquist. Now it's down to seven million, he said. Higher home prices could incentivize more people to list their homes and help ease tight inventory levels.

"They are finally above water, but they need a certain price to justify selling their home," Blomqust said. "If they can't get that, they aren't going to sell."

CNNMoney (New York) March 26, 2015: 10:25 AM ET

Anda sedang membaca artikel tentang

It's getting harder to afford a home

Dengan url

http://kasiatbuatsehat.blogspot.com/2015/03/its-getting-harder-to-afford-home.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

It's getting harder to afford a home

namun jangan lupa untuk meletakkan link

It's getting harder to afford a home

sebagai sumbernya

0 komentar:

Posting Komentar