NEW YORK (CNNMoney)

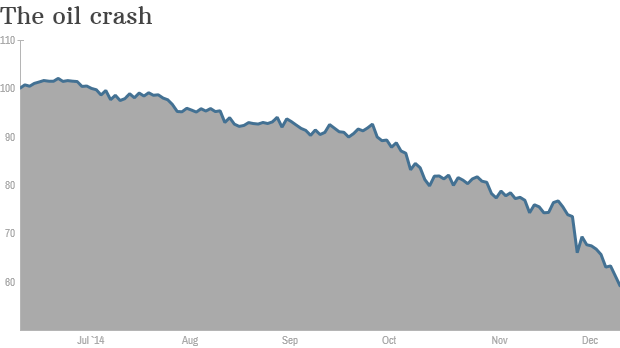

Plunging oil prices have slammed the economies of both countries, which are highly dependent on oil revenue.

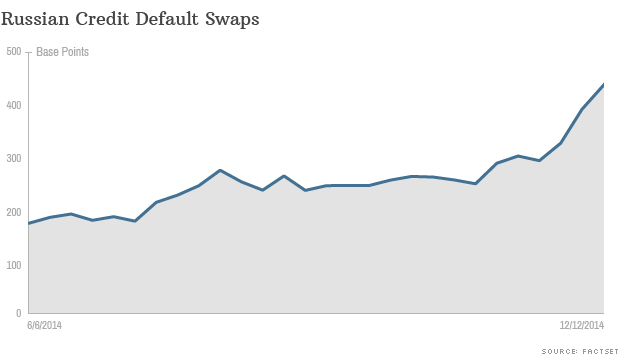

On Wall Street currently, the cost to insure Russia's five-year bonds have surged to the highest levels since 2009.

The fears stem from the fact that the Russian government gets half of its revenue from oil and gas exports. Recently, the ruble has gone into a tailspin and the Russian central bank has hiked interest rates five times this year in an attempt to prop its currency.

Still, despite the state of high alert among Wall Street traders, Moscow does have significant foreign exchange reserves to service its debt. And so far the ratings agencies aren't that concerned.

Standard & Poor's reaffirmed Russia's credit rating in October, though it warned of a downgrade over the next 18 months if the government's finances deteriorate.

The situation seems much more dire for Venezuela. Oil prices have dropped 40% since June.

Oil makes up 96% of its export earnings and Venezuela stands to suffer much more because it costs more to produce it there.

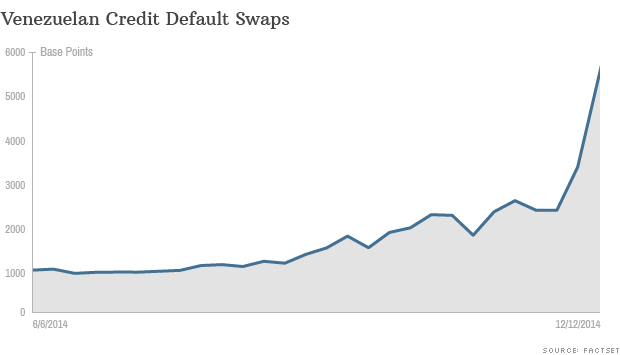

The Venezuelan economy had already been struggling with political instability and sky high inflation. And the spectre of default looms larger for the nation's socialist government, which is deep in debt and has been burning through its foreign currency reserves.

For every dollar that the price of oil declines, the Venezuelan government loses $800 million in export receipts, according to a recent report from the Institute of International Finance.

The government has been selling assets and borrowing from China, but the continued decline in oil prices could force a "massive devaluation" of the Venezuelan currency, the IIF warned.

"Worsening conditions are increasing the risks of default, social unrest and political instability," in Venezuela, according to the IIF.

It's no surprise that the insurance contracts, or the credit default swaps as they known on Wall Street, cost five times more than they did in June. To insure $10 million of Venezuela's five-year bonds, traders today have to pay as much as $5 million.

Related: Break-even point for oil prices at these countries

Related: These countries are getting killed by cheap oil

Related: Plunging oil prices may trigger unrest

First Published: December 12, 2014: 4:24 PM ET

Anda sedang membaca artikel tentang

Wall Street bets on Russia and Venezuela defaults

Dengan url

http://kasiatbuatsehat.blogspot.com/2014/12/wall-street-bets-on-russia-and.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Wall Street bets on Russia and Venezuela defaults

namun jangan lupa untuk meletakkan link

Wall Street bets on Russia and Venezuela defaults

sebagai sumbernya

0 komentar:

Posting Komentar