Click for more market data.

NEW YORK (CNNMoney)

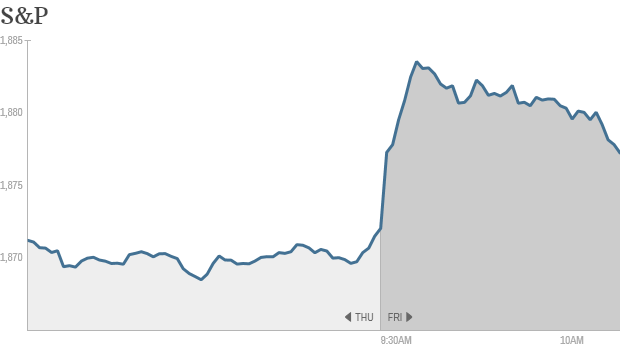

The S&P 500 hit a record high almost immediately after the opening bell in a frenzy of buying that traders said was tied to the expiration of options contracts Friday. The index quickly backed off the highs, but remained higher in early trading.

The Dow Jones industrial average also gave back some of its initial gains. The Nasdaq turned lower.

Stocks could be volatile Friday because four futures and options contracts expire -- a phenomenon known as quadruple witching.

"That's the main driver of the day," said Peter Cardillo, chief market economist at Rockwell Global Capital. He noted that the only other major market-driving news was that 29 of the 30 big banks passed the Federal Reserve's stress test. Regional bank Zions (ZION) was the only one that did not and its shares were down 2% in early trading.

It's been a busy week. The Federal Reserve tweaked the guidance for future policy changes. There have also been rising tensions between the West and Russia and continued concerns about slowing growth in China.

But for the most part, stocks kept pushing higher. As it stands now, the major U.S. indexes look set to close out the week with a healthy gain.

Related: Fear & Greed Index shows greed again

Markets were rattled Wednesday after Fed chair Janet Yellen suggested that the central bank could begin hiking interest rates sooner than expected. But stocks have climbed every other day this week.

The latest reading on the CNNMoney Fear & Greed index shows investors are getting greedy once more.

But the mood isn't quite so perky in Russia, where the stock market and ruble are under pressure after the U.S. announced sanctions against more high-ranking Russian individuals and a bank. Western nations are trying to put pressure on Russia after it annexed Crimea, a region in southern Ukraine.

The impact on global markets from the sanctions "will be real but not drastic," according to analysts at political risk consultancy Eurasia Group.

The analysts said capital flight from Russia "will likely be extremely high" in the first quarter and the sanctions will "send a chill through the Russian banking sector." But the Americans and Europeans are unlikely to impose on Moscow the kind of crippling sanctions they used against Iran, according to Eurasia.

Related: Risks in focus as China's economy slows

There's little U.S. economic or corporate news on the docket Friday. Before the bell, Tiffany (TIF) reported full-year earnings and sales that fell short of forecasts.

Shares of Darden Restaurants (DRI, Fortune 500), the parent company of Red Lobster, officially released its latest quarterly results. Darden had warned earlier this month that profits would be down sharply, but the stock did wind up moving higher in early trading.

Nike (NKE, Fortune 500) shares slid after the company said earnings could be squeezed over the next few quarters.

Symantec (SYMC, Fortune 500)shares plunged after the company fired its CEO. The stock was the worst performer in CNNMoney's Tech 30 index Friday and is now the biggest loser in the index for the year.

Related: CNNMoney's Tech 30

European markets were all rising in morning trading. Asian markets mostly closed with gains. China's yuan fell to a one-year low against the dollar earlier this week as the nation's central bank allows the currency to trade more freely. Investors have also been worried about bankruptcies in China after the nation's first corporate bond default last month. ![]()

First Published: March 21, 2014: 9:52 AM ET

Anda sedang membaca artikel tentang

Stocks pull back from record highs

Dengan url

http://kasiatbuatsehat.blogspot.com/2014/03/stocks-pull-back-from-record-highs.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks pull back from record highs

namun jangan lupa untuk meletakkan link

Stocks pull back from record highs

sebagai sumbernya

0 komentar:

Posting Komentar